Table of Contents

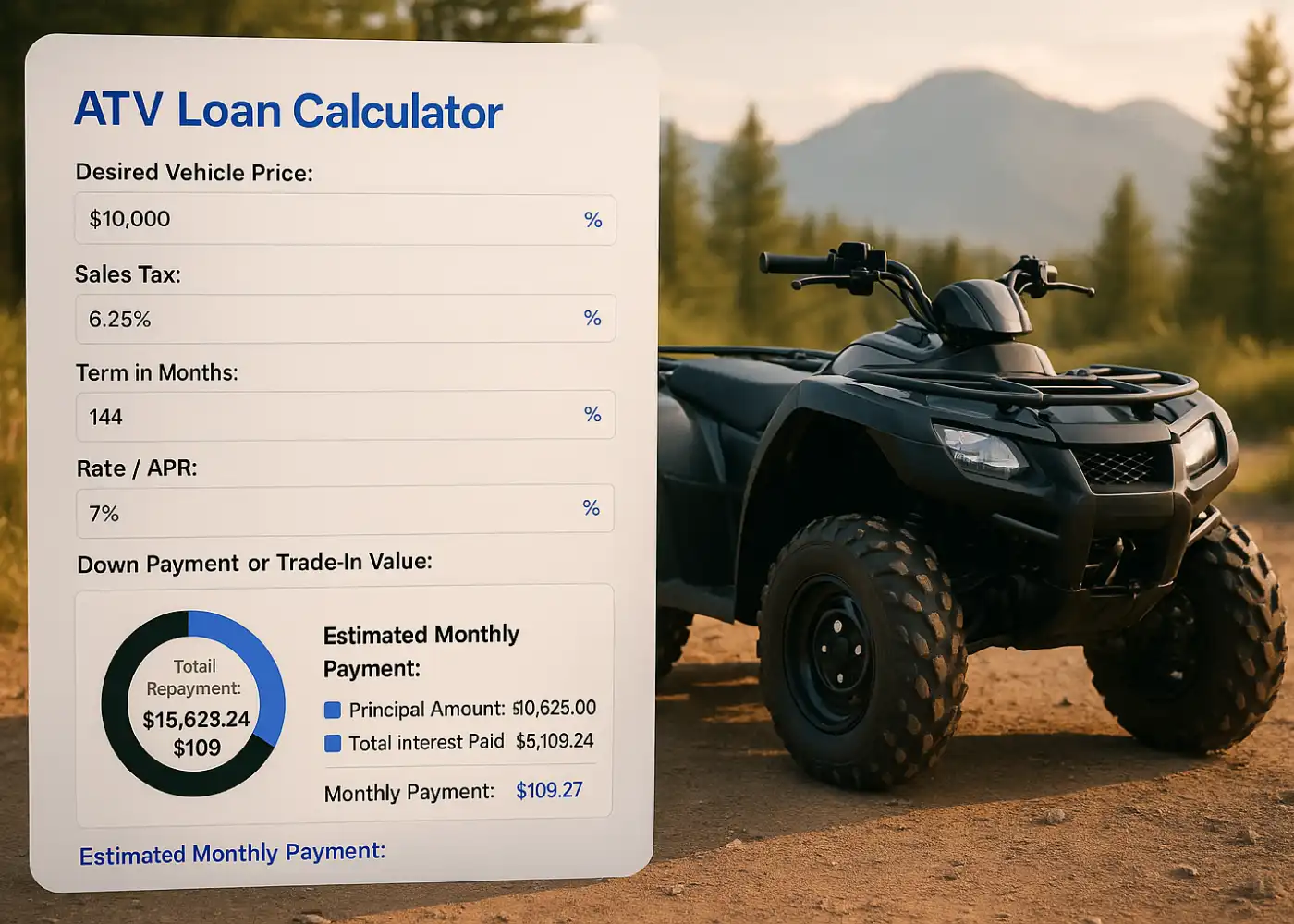

Thinking about buying an ATV, but unsure what your monthly payments will be? Our ATV loan calculator helps you estimate costs quickly using your loan amount, APR, term, down payment, and even taxes.

Simply enter your numbers to see an instant monthly payment and discover the maximum vehicle price you can afford based on your preferred payment, loan term, and budget. Shop with confidence and stay in control of your finances.

You can also see how small changes make a big difference. For example, paying a little more as a down payment or choosing a shorter loan can save money on interest and lower your total cost. This helps you plan smarter, avoid surprises, and make sure your ATV fits both your budget and your lifestyle.

How to Use the ATV Loan Calculator

1. To Calculate Your Monthly Payment

Use this if you already know the ATV’s price.

Step-by-Step:

-

Enter the price of the ATV you want.

-

Type in the sales tax rate (if known, e.g., 6.25%).

-

Add your loan term in months (like 36, 60, or 72).

-

Enter the APR (interest rate) offered by your lender.

-

Add a down payment or trade-in value, if any.

-

Click “Estimate Monthly Payment”.

You’ll see your estimated monthly cost at the bottom.

If you’re shopping for a UTV, check out our easy-to-use UTV loan calculator to estimate your payments.

Typical ATV Loan Terms and Rates

Before using the calculator, it helps to know what each term means. These words often appear on loan offers, so understanding them can save you money and confusion. Here’s a simple breakdown:

| Term | What It Means |

| Loan Amount | The price of the ATV minus your down payment or trade-in. |

| APR | Annual cost of borrowing, shown as a percentage. Includes interest and fees. |

| Term | Loan length in months (e.g., 36, 60, or 72). |

| Monthly Payment | What you’ll pay every month, based on the loan amount, APR, and term. |

| Down Payment | The money you pay up front. Lowers your total loan. |

| Sales Tax | An extra cost is added to the vehicle price, based on your state’s tax rate. |

Typical ATV Loan APR by Credit Score (2025)

Note: These are illustrative ranges compiled from recent lender disclosures and consumer data. Always confirm with your lender.

| Credit Score | Estimated APR Range | What That Means |

|---|---|---|

| 760+ | ~6% – 8% | Prime rates; best promos & lowest fees |

| 700–759 | ~8% – 11% | Still strong; a higher down payment can help |

| 660–699 | ~11% – 14% | Mid-tier; shop multiple lenders |

| 600–659 | ~14% – 18% | Subprime; expect stricter terms |

| <600 | 18%+ or denial | Consider saving for a bigger down payment |

Sources: Consumer Financial Protection Bureau (risk‑based pricing guidance) and Experian’s 2025 State of Credit report.

Knowing these basics helps you get more accurate results and a smarter deal. I remember the first time I looked into buying an ATV, I was focused on the sticker price and didn’t think much about APR, terms, or even sales tax. I assumed I could just divide the cost by 12 months and call it a day.

Big mistake.

When the actual monthly payment came back way higher than I expected, I realized how much those hidden numbers mattered. If I had understood things like loan length and down payment impact, I could’ve planned better and avoided the stress.

That’s why tools like this calculator and knowing the terms make a real difference.

Monthly Payment Formula Explained

To calculate your ATV loan payment, lenders use a simple formula that takes into account your loan amount, interest rate, and loan term. It looks like this:

Where:

-

PMT = your monthly payment

-

PV = loan amount (present value)

-

r = monthly interest rate (APR ÷ 12)

-

n = total number of monthly payments

For example, if you borrow $10,000 at 7% APR for 60 months, your monthly payment would be around $198. This formula ensures your payment stays the same each month, even though the interest portion changes over time.

The good news? You don’t need to solve this yourself; the calculator above does it for you.

Factors That Affect Your Loan Estimate

Your monthly ATV payment isn’t just based on the price; several key factors can raise or lower your estimate. Understanding them helps you plan smarter.

1. Credit Score

Lenders use your credit score to decide your interest rate. The Consumer Financial Protection Bureau (CFPB) explains that a higher score usually gets you a lower APR, and a smaller monthly payment, while a lower score can mean higher rates or even a loan denial.

2. Loan Term

A longer loan term (like 72 or 84 months) can reduce your monthly payment, but you’ll pay more in total interest. A shorter term costs more monthly, but saves money overall.

3. Down Payment

Putting more money down lowers the amount you need to borrow. Even a small down payment can reduce your monthly cost and help you qualify for better rates.

4. ATV Price and Extras

The base price of the ATV is just the start. Upgrades, destination charges, dealer fees, and taxes can all increase the final loan amount and your monthly payment.

5. Dealer or Manufacturer Offers

Special promotional financing, like 0% APR or cash rebates, can make a big difference. These are usually offered through the manufacturer or dealership and may depend on credit approval.

Knowing these factors lets you adjust the right levers and get a payment that works for your budget.

A few days ago, I was talking to a buddy who had his heart set on this $10,000 ATV. He thought he had everything lined up until he saw the loan offer. His credit score wasn’t great, so the lender gave him a 14% APR. He was shocked. The monthly payment came out nearly $70 higher than he expected. I told him, “Man, if you’d checked your credit first, you could’ve worked on it or looked for better offers.

What to Know Before Financing an ATV

Before you apply for an ATV loan, it’s important to understand what really affects your costs. Taking a few smart steps upfront can save you hundreds, or even thousands, over the life of your loan.

1. Check Your Credit Score First

Your credit score directly affects your interest rate. If your score is high, you’ll likely qualify for a lower APR and pay less each month. If it’s low, you might face higher rates or struggle to get approved. According to the Consumer Financial Protection Bureau, lenders use credit scores to set loan terms, a practice called risk‑based pricing.

2. Prequalify Without Hurting Your Score

Prequalification gives you a preview of your loan terms using a soft credit check. It doesn’t affect your score and lets you compare offers before you commit. It’s one of the smartest ways to shop for an ATV loan.

3. Know the Full Cost

ATV prices can rise fast when you add taxes, dealer fees, accessories, and extended warranties. Be sure to budget for the total out-the-door price, not just the base model.

4. Set a Monthly Budget

Decide how much you can afford to pay each month without stretching your finances. A payment calculator can help you stay within budget, and if you’re planning a driveway or trail, our Asphalt Calculator can help estimate material costs.

A while back, I was helping a friend buy an ATV. He thought he had it all figured out, price, loan, everything. But when the lender came back with a high APR due to his credit score, his monthly payment shot up by $70. That moment stuck with me. I realized how many buyers walk into financing unprepared, just like he did. That’s why I built this calculator, to help others avoid the same shock and plan smarter from the start.

Refinancing Options for ATV Loans

If your current ATV loan feels too expensive, refinancing could help you save money or simplify payments. It’s like trading in your old loan for a new one with better terms, ideally, a lower APR, lower monthly payment, or shorter loan term.

When It Makes Sense

Refinancing is most helpful when your financial situation has improved since you got the original loan.

-

Your credit score has gone up

-

Interest rates have dropped

-

Your income has increased

-

You want to remove a co-signer

-

You want to change lenders

Things to Watch For

Before refinancing, make sure the savings are worth it. Watch out for hidden costs or longer terms that add more interest.

-

Check for prepayment penalties on your current loan

-

Compare fees on the new loan

-

Avoid extending the term too long; it can reduce payments but increase total interest.

-

Make sure your new rate is truly better than the old one

Final Thoughts

Thinking about buying an ATV, but not sure what your monthly payments will be? Our ATV loan calculator makes it easy to estimate your costs using your loan amount, APR, term, and down payment. Just enter your numbers and get an instant monthly payment estimate so you can plan ahead without surprises.

Understanding loan terms like APR, loan length, and down payment can save you money and stress, just like my friend who faced a shock from a high interest rate because he wasn’t prepared. Using this calculator and knowing what affects your loan will help you shop smarter and buy with confidence.

Frequently Asked Questions

Got questions? Our FAQs cover common topics about how our tools work, tips for accurate calculations, and guidance on using InterCalculator for everyday money decisions.

Why should I calculate ATV loan payments before buying?

Calculating payments in advance helps you understand the true cost of financing. It ensures you choose a loan plan that fits your monthly budget and avoids surprises later.

What factors affect my ATV loan interest rate?

Your credit score, loan term, down payment amount, and the lender you choose all influence the interest rate. A stronger credit profile usually leads to better loan offers.

Can financing an ATV improve my credit score?

Yes, making consistent on-time payments toward your ATV loan can help build or improve your credit history. However, missed payments may hurt your score.

What’s the typical loan term for an ATV?

ATV loans often range from 24 to 72 months. Shorter terms have higher monthly payments but less interest overall, while longer terms lower your monthly payment but cost more in total interest.

Is it better to get ATV financing through a dealer or a bank/credit union?

This calculator was created by the InterCalculator Editorial Team, led by Haris Farooq (Formula & Development). Our team specializes in formula research, calculator logic, and technical development, ensuring each tool is accurate, fast, and easy to use.

View Editorial Team →Before publishing, the ATV Loan Calculator is thoroughly reviewed for accuracy. We verify formulas against trusted financial sources, test real-world scenarios, confirm results match benchmarks, and consult lending experts to ensure reliable and clear outputs.

View Process →