Your equipment just broke down. You need $50,000 by Friday to keep your business running. Do you wait three weeks for a bank loan or grab fast funding in 48 hours and pay double the interest? I faced this exact choice last year when my restaurant’s walk-in freezer died during peak season.

Here’s the thing: most business owners don’t know the real difference between fast business funding and traditional bank loans. They just pick whatever sounds quickest or cheapest without understanding what they’re actually signing up for.

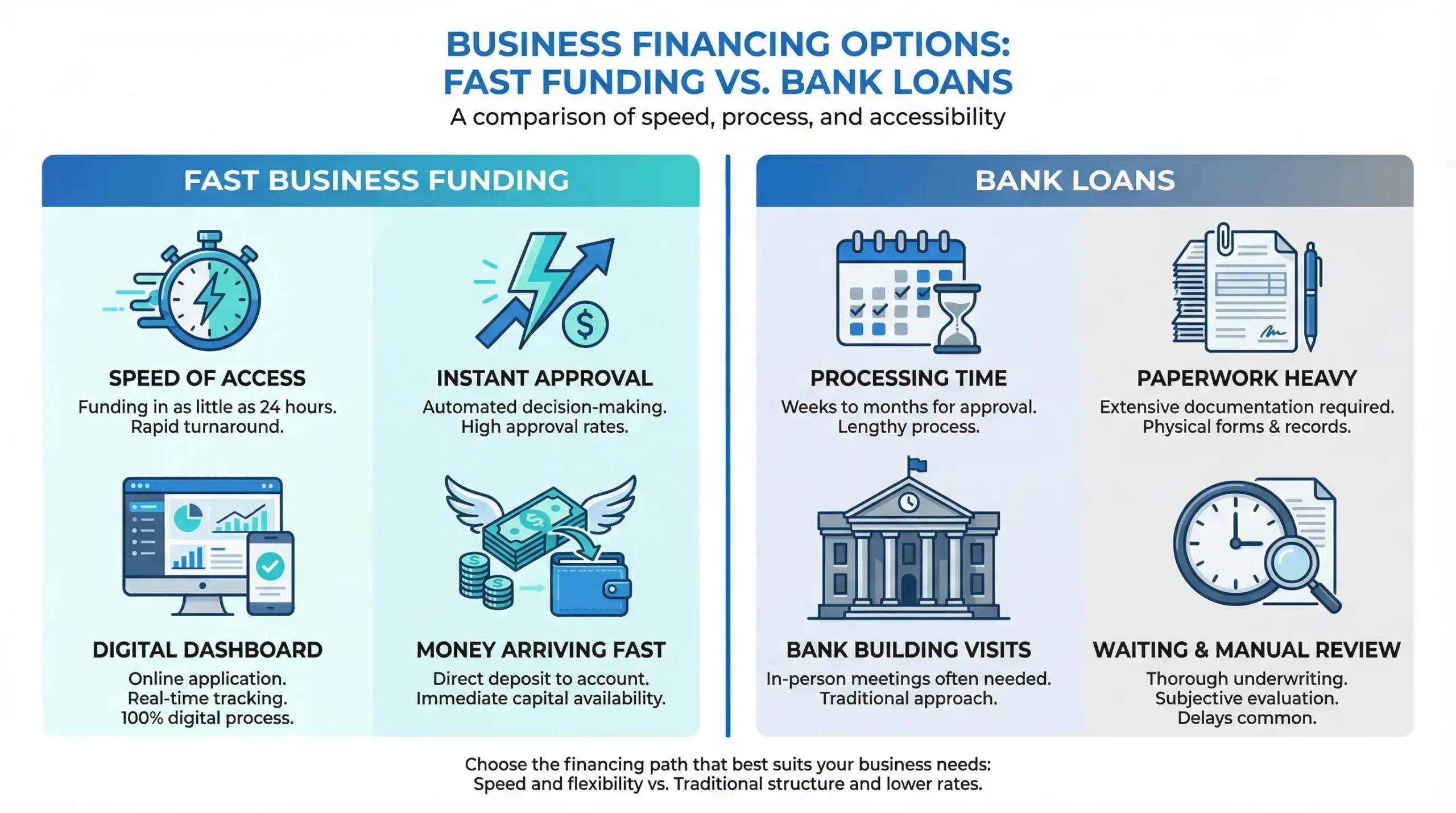

Fast business funding can get you money in 24 to 72 hours, but you’ll pay higher interest rates. Bank loans take weeks or even months, but they’re cheaper in the long run. The question isn’t which one is better, it’s which one fits your situation right now.

In this guide, I’ll show you exactly how these two options compare. You’ll learn when to choose speed over cost, what eligibility requirements you actually need to meet, and how to avoid the biggest mistakes I see small business owners make every single day.

By the end, you’ll know which path makes sense for your business, whether you need emergency cash tomorrow or you’re planning a big expansion six months from now.

Let’s break it down.

Understanding Fast Business Funding

What Is Fast Business Funding?

Fast business funding is exactly what it sounds like, you get money quickly. We’re talking 24 to 72 hours from the moment you apply to when cash hits your business bank account.

Unlike traditional bank loans that take weeks of paperwork and waiting, fast funding cuts through all that. You fill out a simple online application, connect your bank account, and boom, approved or denied within hours.

Here’s how it works: online lenders and fintech companies use computers to check your business instantly. They look at your monthly sales, how long you’ve been open, and your credit score. No long meetings. No stacks of documents. Just fast decisions.

The trade-off? You pay more for speed. These alternative lenders charge higher interest rates because they’re taking bigger risks and moving faster than banks ever could.

Most fast business lenders are not your local bank. They’re companies like Fundbox, OnDeck, or Bluevine, tech companies that live online and specialize in getting small businesses funded fast when time matters most.

Types of Fast Business Funding

Not all fast funding looks the same. Here are the main types you’ll see:

- Short-term loans give you a lump sum of money that you pay back in 3 to 24 months. Think of it like borrowing $20,000 and paying it back weekly or monthly with interest. Simple and direct.

- Merchant cash advances are different. The lender gives you money now, and you pay them back a percentage of your daily credit card sales. Busy day? You pay more. Slow day? You pay less. It’s flexible but expensive.

- Business lines of credit work like a credit card for your business. You get approved for, say, $50,000, but you only use what you need. Pay it back, and you can borrow again. Perfect for cash flow gaps.

- Invoice factoring lets you sell your unpaid invoices to get cash immediately. If a customer owes you $10,000 but won’t pay for 60 days, a factoring company gives you $8,500 today and collects from your customer later.

- Revenue-based financing means you repay based on your monthly revenue. Make $100,000 this month? You pay more. Make $50,000 next month? You pay less. It adjusts with your business ups and downs.

Understanding Traditional Bank Loans

What Are Traditional Bank Loans?

Traditional bank loans are the old-school way to borrow money for your business. You walk into a bank or credit union, fill out tons of paperwork, and wait weeks for an answer.

These loans come from places like Bank of America, Wells Fargo, or your local credit union. Some also come from SBA lenders, banks that offer government-backed SBA loans with lower rates.

The timeline? Expect 2 to 6 weeks minimum. Sometimes months if you’re going for an SBA loan. They check everything, your credit history, tax returns, business plan, the works.

Why so slow? Banks want to be absolutely sure you can pay them back. They’re not taking risks like online lenders do.

Types of Bank Loans Available

- Term loans are straightforward. Borrow $100,000, pay it back monthly over 5 years with fixed interest rates. Clean and simple.

- SBA 7(a) loans are backed by the government and offer the lowest rates—around 7% to 10%. Great for working capital or buying a business. Just be ready to wait 60 to 90 days.

- SBA 504 loans are for big purchases like buildings or heavy equipment. You can borrow up to $5 million with super long repayment terms.

- Commercial real estate loans help you buy property for your business. Think storefronts, warehouses, or office buildings.

Fast Business Funding vs Bank Loans: Key Differences

Speed of Approval and Funding

Let me tell you what happened to my friend Sarah. Her bakery’s oven died on a Monday. She applied for fast business funding that same morning and had $15,000 in her account by Wednesday. If she’d gone to her bank? She’d still be waiting three weeks later while her business sat idle.

That’s the biggest difference right there, speed.

With fast funding, you get approved in minutes to hours. Seriously. Most online lenders use automated systems that check your business bank account and credit score instantly. You click submit, grab coffee, and often have an answer before you finish drinking it.

The money shows up fast too. Once approved, funds hit your account in 1 to 3 days. Some lenders even do same-day funding if you apply early enough in the morning.

Bank loans? Totally different world. The approval process takes days to weeks because a real person reviews everything manually. They check your business plan, financial statements, tax returns—all of it. Even after approval, funding takes another 1 to 7 days.

SBA loans are the slowest of all. We’re talking 30 to 90 days from application to getting your money. Sometimes longer if there are issues with your paperwork. The Small Business Administration guarantees these loans, so there’s extra review and government red tape involved.

Here’s the honest truth: if you need money this week, banks won’t help you. If you can wait and want to save thousands in interest, banks are your friend.

Funding Speed Comparison

| Loan Type | Approval Time | Funding Time | Total Time |

|---|---|---|---|

| Fast Business Funding | Minutes to hours | 1-3 days | 1-3 days total |

| Traditional Bank Loan | 3-14 days | 1-7 days | 1-3 weeks total |

| SBA Loan | 30-60 days | 7-14 days | 30-90 days total |

| Merchant Cash Advance | Same day | 1-2 days | 1-2 days total |

| Business Line of Credit (Bank) | 7-21 days | 3-5 days | 2-4 weeks total |

The pattern is clear: you’re trading time for money. Fast funding costs more but saves you time. Bank loans cost less but require patience you might not have when emergencies hit.

Eligibility Requirements Comparison

Credit Score and Business History Requirements

Here’s where things get interesting. Fast business funding and bank loans look for completely different types of borrowers.

With fast funding, you can get approved with a credit score as low as 500 to 600. I’ve seen online lenders approve businesses that banks wouldn’t even look at. Your business only needs to be open for 6 months—sometimes even less with certain lenders.

Why so lenient? Alternative lenders focus more on your monthly revenue and sales trends than your credit history. If you’re making $10,000 a month consistently, they’ll take the risk even if your credit isn’t perfect.

Banks are the opposite. They want to see a credit score of 680 or higher—preferably 700+. Your business needs at least 2 years of operating history, sometimes more for larger loans. They want proof you’ve survived the rough startup phase.

Revenue requirements differ too. Fast lenders might ask for $10,000 to $25,000 in monthly revenue. Banks often want $100,000+ in annual revenue and detailed financial statements showing steady growth.

Eligibility Requirements Side-by-Side

| Requirement | Fast Business Funding | Traditional Bank Loans |

|---|---|---|

| Minimum Credit Score | 500-600 | 680-720 |

| Time in Business | 6 months | 2+ years |

| Monthly Revenue | $10,000-$25,000 | Variable (higher) |

| Annual Revenue | $100,000+ | $250,000+ |

| Documentation | Bank statements, basic info | Tax returns, financial statements, business plan |

| Approval Rate | Higher (more flexible) | Lower (strict criteria) |

| Best For | Newer businesses, lower credit | Established businesses, strong credit |

Collateral and Personal Guarantee Differences

Most fast business funding is unsecured—meaning you don’t need to put up your car, house, or equipment as collateral. That sounds great, right? Well, here’s the catch: they usually require a personal guarantee instead.

A personal guarantee means if your business can’t pay, you’re personally on the hook. Your personal assets could be at risk, but at least you’re not handing over your truck as security upfront.

Bank loans work differently. They almost always want collateral—something valuable they can take if you default. Real estate, equipment, inventory, whatever has value. For SBA loans especially, banks want both collateral and a personal guarantee. Double protection for them.

The risk here is real. With fast funding, you risk your personal credit and finances if things go wrong. With bank loans, you risk losing specific business assets you pledged. Neither is fun to think about, but you need to know what you’re signing up for.

Honestly? If you don’t have assets to lose, fast funding might feel safer. If you’ve got property and want the cheapest rates, banks are worth the extra security requirements.

Cost Comparison: Interest Rates and Fees

Interest Rates and APR

Let’s talk money. This is where fast business funding really hits your wallet compared to bank loans.

Fast funding can cost anywhere from 20% to 150% APR. Yeah, you read that right—150%. Some merchant cash advances are even worse. The speed and easy approval come with a massive price tag.

Many online lenders don’t even use normal interest rates. They use something called a factor rate—numbers like 1.1, 1.2, or 1.5. Here’s how it works: borrow $10,000 with a 1.3 factor rate, and you pay back $13,000 total. Sounds simple, but when you calculate the actual APR, it’s often 40% to 80% or higher.

Bank loans? Completely different universe. You’re looking at 6% to 20% APR for most traditional bank loans. SBA loans can go as low as 7% to 10% because the government backs them. That’s a huge difference over time.

Let me show you the real impact: borrow $50,000 for one year. At 10% APR (bank loan), you pay about $2,750 in interest. At 50% APR (fast funding), you pay $13,750 in interest. That’s over $10,000 extra just for getting money faster.

Interest Rate Comparison Table

| Loan Type | Typical APR Range | Factor Rate (if applicable) | Total Cost on $50K (1 year) |

|---|---|---|---|

| SBA Loan | 7%-10% | N/A | ~$2,500-$3,500 |

| Traditional Bank Loan | 8%-20% | N/A | ~$3,000-$7,000 |

| Online Term Loan | 15%-40% | Sometimes 1.2-1.4 | ~$6,000-$15,000 |

| Merchant Cash Advance | 40%-150% | 1.3-1.5 | ~$15,000-$35,000 |

| Business Line of Credit (Fast) | 10%-80% | N/A | ~$4,000-$25,000 |

| Invoice Factoring | N/A (fee-based) | 1-5% per invoice | ~$2,500-$10,000 (varies) |

Fees and Additional Costs

Interest rates aren’t the whole story. The fees can absolutely wreck your budget if you’re not careful.

- Fast funding loves to pile on fees. You’ve got origination fees (2% to 8% of the loan amount), application fees ($50 to $500), processing fees, and sometimes even monthly maintenance fees. A $30,000 loan with a 5% origination fee means you’re paying $1,500 just to get the money.

- Prepayment penalties are tricky with fast lenders. Some don’t charge them at all—you can pay off early and save on interest. Others charge you the full interest anyway, even if you pay back in two months instead of twelve. Always ask about this before signing.

- Bank loans have fees too, but they’re usually lower. Expect 0.5% to 2% origination fees. SBA loans might add guarantee fees (around 2% to 3.75%). The difference? A $30,000 bank loan might cost $300 to $600 in fees versus $1,500+ with fast funding.

Here’s what shocked me: some merchant cash advances hide their true costs. They don’t call it interest—they call it a “fee” or “discount.” You think you’re paying 20%, but the real APR works out to 70% or higher.

Always calculate the total cost of borrowing. Add up all fees, all interest, everything. Then divide by how much you actually receive. That’s your real cost.

Cost Breakdown Example

| Fee Type | Fast Funding | Bank Loan |

|---|---|---|

| Origination Fee | 2%-8% | 0.5%-2% |

| Application Fee | $0-$500 | $0-$150 |

| Prepayment Penalty | Varies (often full interest) | Sometimes 1%-3% |

| Monthly Fees | $0-$100 | Usually $0 |

| Late Payment Fee | $50-$150 | $25-$75 |

The bottom line? Fast funding costs more, sometimes way more. To understand how today’s borrowing choice affects your long-term costs, you can use our free future value calculator to see how interest rates and repayment timelines change the total amount you’ll pay over time. You pay a premium for speed and convenience. Banks cost less but make you jump through hoops to get there.

Pros and Cons of Fast Business Funding

Advantages of Fast Funding

Quick Access to Capital (24-48 Hours)

The biggest win with fast business funding is speed. You can have money in your business bank account within 24 to 48 hours. When your delivery truck breaks down or you need to buy inventory before a sale ends, this speed is a lifesaver.

I once needed $8,000 to fix my café’s espresso machine during the holiday rush. Applied Tuesday morning, had the cash Wednesday afternoon. That machine paid for itself in two weeks.

Easier Qualification (Lower Credit Scores, Newer Businesses)

Got a credit score of 550? Newer business that’s only been open 8 months? Fast lenders don’t care as much as banks do. They’ll look at your monthly revenue and daily sales instead of obsessing over your credit history.

This opens doors for startups and business owners who banks won’t even talk to.

Less Documentation Required

Forget the mountain of paperwork banks demand. With fast funding, you typically just need your bank statements, basic business info, and maybe your ID. No business plan. No three years of tax returns. Just simple stuff.

Most online applications take 10 minutes or less. That’s it.

Flexible Use of Funds

Here’s what I love: you can use fast funding for almost anything. Payroll, inventory, repairs, marketing—whatever your business needs. Banks often restrict what you can spend loan money on, but online lenders usually don’t care as long as you pay them back.

Disadvantages of Fast Funding

Higher Interest Rates and Fees

This is the painful part. Fast funding can charge 30% to 150% APR, sometimes even higher. Plus origination fees, processing fees, and all sorts of other charges that add up fast.

You’re basically paying a huge premium for speed and convenience. A $20,000 loan might cost you $5,000 or more in interest and fees over one year.

Shorter Repayment Terms

Most fast business loans want their money back in 3 to 24 months. Some merchant cash advances take payments daily or weekly. That’s a lot of pressure on your cash flow compared to a 5-year bank loan with easy monthly payments.

Short terms mean big payments, and that can hurt.

Frequent weekly or daily repayments can quietly strain your cash flow. A compound interest calculator with withdrawals helps you calculate how ongoing repayments and higher APRs impact your total repayment, making it easier to judge whether fast funding is financially sustainable.

Potential Cash Flow Strain

Here’s where businesses get into trouble. Those weekly payments or daily deductions from your sales can squeeze your cash flow tight. Make one slow month, and suddenly you’re struggling to cover rent and the loan payment.

I’ve seen businesses take out fast funding to solve one problem, then create a bigger problem by not being able to afford the aggressive repayment schedule.

Lower Borrowing Limits

Need $500,000 for a major expansion? Fast funding probably won’t cut it. Most online lenders cap out at $250,000 to $500,000, some even lower. Banks and SBA loans can go into the millions if you qualify.

If you need serious money, you’re likely stuck going the traditional route.

When to Choose Fast Business Funding

Fast business funding makes sense when time matters more than cost. If you’re facing an emergency, a time-sensitive opportunity, or you simply can’t wait weeks for a bank loan, this is your best bet.

Research from the National Federation of Independent Business shows that nearly 40% of small businesses face unexpected expenses each year, making quick access to working capital a survival issue, not just a convenience.

Here’s when fast funding is the smart move:

| Situation | Why Fast Funding Works | Example |

|---|---|---|

| Equipment Breakdown | Get repairs done immediately before losing more revenue | Restaurant freezer dies, need $15K within 48 hours |

| Unexpected Expenses | Cover urgent costs that can’t wait | Surprise tax bill, emergency repairs, broken machinery |

| Time-Sensitive Inventory | Grab limited-time deals or seasonal stock | Black Friday inventory discount expires in 3 days |

| Seasonal Cash Flow Gaps | Bridge slow months until busy season returns | Landscaping business needs payroll during winter |

| Late-Paying Clients | Cover expenses while waiting for invoices to clear | Client owes $20K but won’t pay for 60 days |

| New Business (Under 2 Years) | Banks won’t approve you, but fast lenders will | 8-month-old startup needs working capital |

| Low Credit Score (500-650) | Traditional lenders reject you automatically | Bad personal credit but strong monthly sales |

| Quick Growth Opportunity | Must act fast to capture market opportunity | Competitor closes, chance to buy their equipment cheap |

Choose fast business funding when waiting costs you more money than the higher interest rates will.

Final Thoughts

Choosing between fast business funding and bank loans isn’t about finding the “best” option—it’s about finding the right fit for where your business is today.

Need money this week because your equipment broke or you found a killer deal on inventory? Fast funding is your answer, even with those higher interest rates. But if you’re planning a big expansion six months out and you’ve got solid credit, take the time to get a bank loan and save thousands.

For long-term financial planning, it helps to compare debt repayment with passive income potential. A dividend calculator lets you estimate future dividend earnings, which can support smarter decisions around reinvesting profits versus borrowing.

Here’s my honest advice: don’t let pride or impatience guide this decision. I’ve seen business owners choose fast funding when they didn’t actually need speed, then regret paying 50% APR when a bank would’ve given them 10%. I’ve also seen people wait for bank approval while their competitor grabbed the opportunity first.

Look at your situation right now. What’s your credit score? How urgent is the need? Can your cash flow handle aggressive weekly payments, or do you need gentle monthly installments spread over years?

Some business owners also compare borrowing costs with potential investment returns. Using a stock average calculator allows you to estimate how investing gradually over time compares to paying high-interest business funding, helping you evaluate opportunity cost more clearly.

There’s no shame in either choice. Sometimes you need speed. Sometimes you need savings. Sometimes you need both, fast funding today, then refinance with a cheaper bank loan later once you’ve stabilized.

The worst mistake? Doing nothing because you’re overwhelmed by options. Pick the path that keeps your business moving forward, then adjust as you grow.