Running a business means you need money fast sometimes. Maybe your equipment breaks down, or you see a great deal you can’t miss. That’s when short term business loans save the day.

I remember when my friend Sarah ran a small bakery. One winter, her oven stopped working right before the holiday rush. She didn’t have enough cash saved up. A short term loan helped her buy a new oven in just three days. She made all her holiday orders and paid back the loan in four months.

Short term loans are different from regular bank loans. You get money quickly, usually in a few days. You pay it back faster too, often in 3 to 18 months. They’re perfect when you need cash now and can pay it back soon.

In this guide, I’ll show you the best lenders, how to qualify, and how to pick the right loan. Let’s help you find the money your business needs.

What Are Short Term Business Loans?

A short term business loan is money you borrow and pay back quickly. Most people pay these loans back in 3 to 18 months. Some lenders let you take up to 24 months, but that’s less common.

These loans are smaller than traditional bank loans. You might borrow anywhere from $2,500 to $500,000. The amount depends on your business income and credit history.

The best part? You can get approved fast. Some lenders give you an answer in hours, not weeks. The money hits your account in 1 to 3 business days usually.

How Short Term Loans Differ from Traditional Loans

Traditional bank loans take a long time. You fill out lots of papers. Banks check everything about your business. It can take 30 to 90 days to get your money.

Short term loans work faster. Online lenders use technology to check your business quickly. They look at your bank statements and revenue. Many don’t need perfect credit scores.

Here’s what makes them different:

- Speed – You get money in days, not months. Traditional loans take weeks or months to process.

- Requirements – Short term lenders are more flexible. You might qualify with a credit score of 600. Banks usually want 680 or higher.

- Paperwork – Less forms to fill out. Some lenders only need your bank statements and ID.

- Repayment – You pay back faster. This means higher payments each month, but you’re done sooner. Traditional loans spread payments over 5 to 25 years.

According to a study published by the Federal Reserve, small businesses that need quick funding often turn to alternative lenders because traditional banks reject about 50% of small business loan applications.

Common Uses for Short Term Business Funding

Business owners use short term loans for many reasons. Let me share the most common ones I’ve seen.

- Emergency repairs – When equipment breaks, you can’t wait. A restaurant owner I know got a loan when his freezer died. He needed it fixed before all his food went bad.

- Inventory purchases – Retailers use these loans to buy stock for busy seasons. If you run a toy store, you need extra inventory before Christmas. A short term loan helps you stock up.

- Cash flow gaps – Sometimes customers pay late. You still have bills to pay. These loans bridge the gap until money comes in.

- Marketing campaigns – A quick advertising push can bring in new customers. If you see a good opportunity, a short term loan lets you grab it.

- Hiring temporary staff – During busy seasons, you might need extra workers. The loan covers their wages until sales increase.

Most business owners don’t use these loans for long-term investments. You wouldn’t buy a building with a short term loan. The payments are too high for that. Instead, use them for things that will make money quickly.

Top 7 Best Short Term Business Loan Lenders

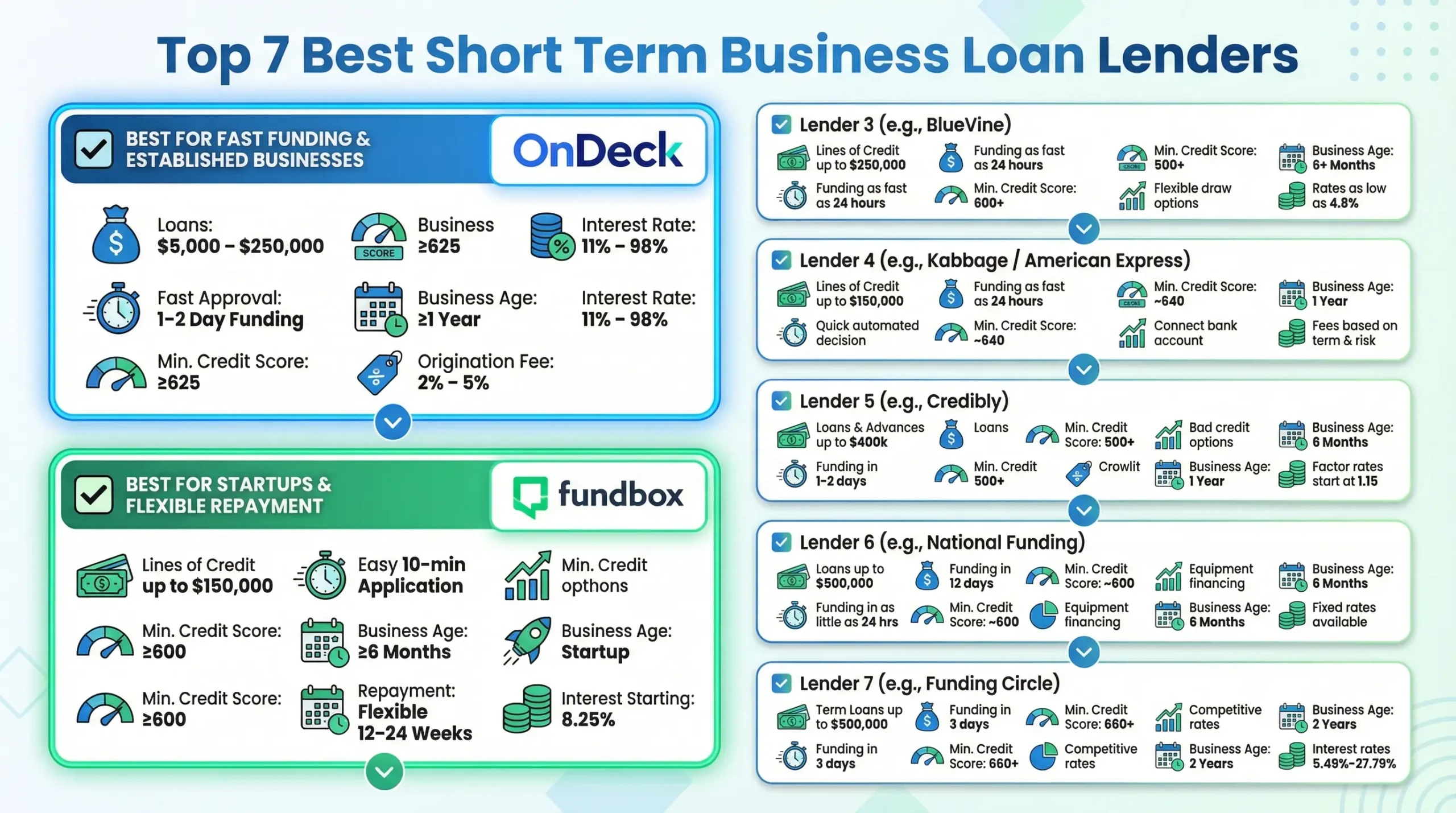

After looking at dozens of lenders, I found seven that really stand out. Each one has different strengths. Let me walk you through them.

OnDeck: Fast Approval for Established Businesses

OnDeck works great if your business has been around for a while. They’ve been lending since 2007, so they know what they’re doing.

You can borrow between $5,000 and $250,000. The money arrives in your account in 1 to 2 business days after approval. That’s pretty fast.

Their requirements are fair. You need a credit score of at least 625. Your business should make at least $100,000 per year. You also need to be in business for at least one year.

The interest rates range from about 11% to 98% APR. That’s a big range. Your rate depends on your credit and how risky your business looks.

I like OnDeck because they’re straightforward. Their website shows you what you might qualify for before you apply. No surprises later.

One thing to know – they charge an origination fee. This is a one-time charge when you get the loan. It’s usually 2% to 5% of your loan amount.

Fundbox: Best for Startups with Low Revenue

Fundbox helps newer businesses. If your company is small or just starting, they might work with you when others won’t.

They offer lines of credit up to $150,000. A line of credit is different from a loan. You only borrow what you need, when you need it. You only pay interest on the money you actually use.

Fundbox has low requirements. You only need a credit score of 600. Your business can be as young as 6 months old. You need to make at least $100,000 per year, but that’s less than many lenders ask for.

The repayment terms are flexible. You can pay back over 12 or 24 weeks. Weekly payments are automatic, taken from your bank account.

Interest rates start around 8.25% for the first 12 weeks. If you need more time, rates go higher. Still, it’s often better than a credit card.

What I really like about Fundbox is how easy they make it. The whole application takes about 10 minutes online. You connect your bank account, and they check your business automatically.

How to Qualify for a Short Term Business Loan

Getting approved isn’t as hard as you might think. But you do need to meet some basic rules. Let me break it down for you.

Credit Score and Financial Requirements

Your credit score matters a lot. It’s a number that shows how well you pay back money you borrow. The score goes from 300 to 850. Higher is better.

Most short term lenders want a score of 600 or above. Some will work with you if your score is 550, but you’ll pay higher interest. If your score is below 500, it gets really hard to find a lender.

Here’s something important – lenders look at both your personal and business credit. Even if your business is new, they check your personal score. This makes sense when you think about it. If you pay your personal bills late, why would they trust you with business money?

Revenue requirements vary by lender. Most want to see that your business makes at least $100,000 per year. Some are okay with $50,000. They check this by looking at your bank statements.

Time in business counts too. Most lenders want you to be in business for at least 6 to 12 months. A few will work with brand new businesses, but it’s tougher.

Your debt-to-income ratio is another thing they check. This compares how much debt you have to how much money you make. If you already owe a lot, lenders worry you can’t handle more payments.

According to data from the U.S. Small Business Administration, businesses with consistent revenue and manageable debt have the highest approval rates for alternative financing options.

Documentation You’ll Need to Apply

Getting your papers ready makes everything faster. Most lenders ask for similar documents. Let me tell you what to prepare.

- Bank statements – Usually the last 3 to 6 months. These show your business income and expenses. Make sure they’re from your business bank account, not your personal one.

- Business tax returns – Many lenders want to see your last 1 to 2 years of tax returns. If your business is new, they might skip this.

- Driver’s license or ID – They need to know you’re really you. A clear photo of your ID works.

- Business license – If your city or state requires one, have it ready. Not all businesses need this, so don’t worry if you don’t have one.

- Proof of ownership – Documents showing you own the business. This could be your LLC papers, partnership agreement, or DBA certificate.

Some lenders might ask for more. If you have collateral (like equipment or property), they want to see proof you own it. But many short term loans are unsecured, which means you don’t need collateral.

Here’s a tip that saved me time – scan all your documents before you start applying. Save them on your computer or phone. This way, when a lender asks for something, you can send it right away. Fast responses help you get approved faster.

Pros and Cons of Short Term Business Loans

Like everything in business, short term loans have good points and bad points. Let me be honest about both.

Benefits of Quick Business Funding

- Speed is the biggest advantage. When you need money now, these loans deliver. I’ve seen businesses get funded in 24 hours. Traditional banks can’t match that.

- Easier approval process – You don’t need perfect credit. If banks turned you down, online lenders might say yes. They look at your whole business, not just one number.

- Less paperwork – Remember those huge stacks of forms at banks? Online lenders keep it simple. You can apply from your phone while drinking coffee.

- Build business credit – When you pay back on time, your business credit score improves. This helps you get better loans later.

- No long-term commitment – You’re done paying in less than 2 years. With traditional loans, you might be paying for 10 years or more.

- Flexible use – Most lenders don’t tell you exactly how to spend the money. You know your business best. Use it where you need it.

Honestly, the speed alone makes these loans worth it sometimes. When my cousin’s plumbing business had three trucks break down in one week, a short term loan saved him. He got trucks fixed and didn’t lose customers.

Potential Drawbacks to Consider

Now for the not-so-fun part. Short term loans have real downsides you need to know about.

- Higher interest rates – These loans cost more than traditional bank loans. Way more sometimes. Annual rates can hit 80% or even 100% with some lenders. That’s rough.

- Frequent payments – Many lenders want daily or weekly payments. This can strain your cash flow. You’re always making payments, which can feel overwhelming.

- Shorter repayment period – Paying back in months instead of years means bigger payments. If business slows down, those payments don’t stop.

- Fees add up – Origination fees, processing fees, early payment penalties. Some lenders charge for everything. Read the fine print carefully.

- Can create a debt cycle – If you can’t pay back on time, you might need another loan to cover the first one. This cycle is hard to break.

- May require personal guarantee – If your business can’t pay, you’re personally responsible. Your personal credit and assets are at risk.

A report from the Consumer Financial Protection Bureau found that small businesses often face challenges understanding the true cost of short-term financing due to complex fee structures.

I’m not trying to scare you. Just be smart about it. Only borrow what you really need. Have a clear plan to pay it back. Don’t use these loans for things that won’t make money.

How to Choose the Right Short Term Loan for Your Business

Picking the wrong loan is expensive. Let me help you choose wisely.

Comparing Interest Rates and Fees

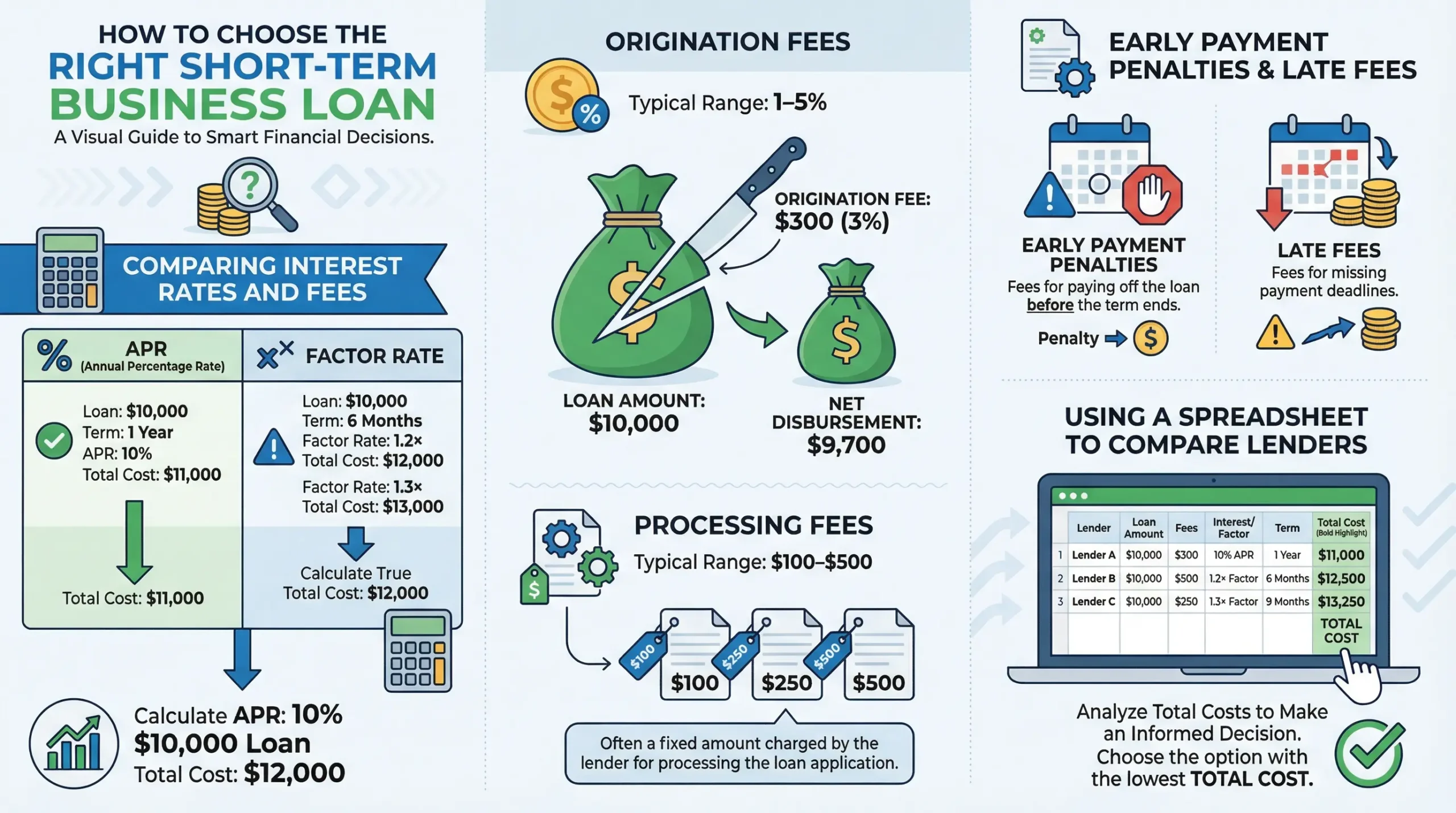

Interest rates tell you how much the loan costs. But here’s the tricky part – lenders show rates in different ways. Some use APR (annual percentage rate). Others use factor rates. This makes comparing hard.

Let me explain factor rates. Instead of a percentage, you get a number like 1.2 or 1.4. If you borrow $10,000 with a factor rate of 1.3, you pay back $13,000 total. Simple math, but it hides the true cost.

Always ask for the APR. This shows the real yearly cost, including all fees. It’s the only fair way to compare different lenders.

Watch out for these fees:

- Origination fees – Charged when you get the loan. Usually 1% to 5% of the loan amount. A $10,000 loan with a 3% fee means you only get $9,700, but you pay back $10,000 plus interest.

- Processing fees – Some lenders charge this just to look at your application. It’s usually $100 to $500.

- Early payment penalties – Sounds crazy, but some lenders charge you for paying back early. They want all that interest money. Avoid these lenders if you can.

- Late payment fees – If you miss a payment, expect to pay $30 to $50 extra. Plus your interest rate might go up.

Here’s what I do – I use a spreadsheet. I list each lender, their rate, all their fees, and the total cost. Then I can see clearly which one costs less overall.

Understanding Repayment Terms and Flexibility

Repayment terms are how and when you pay back the money. This is super important for your cash flow.

Some lenders want daily payments. They take a small amount from your bank account every single day. This works okay if you have daily sales, like a restaurant. But if you’re a contractor who gets paid once per project, daily payments are tough.

Weekly payments are more common. Every Monday (or whatever day), money comes out of your account. This is easier to plan for than daily.

Monthly payments are the easiest to manage. You pay once a month, just like rent or utilities. But fewer lenders offer this for short term loans.

Ask about flexibility before you sign anything. Good questions to ask:

- Can I skip a payment if business is slow? Some lenders let you pause once or twice without penalty.

- What happens if I pay early? Will they charge me extra, or can I save on interest?

- Can I adjust my payment schedule? Maybe switch from weekly to monthly if things change.

- What if I need more money later? Some lenders let you increase your loan amount if you’ve been paying well.

I learned this the hard way. My first business loan had weekly payments. Then I landed a big contract that paid monthly. For three weeks each month, I struggled to make loan payments while waiting for my customer to pay me. It was stressful. Now I always match my payment schedule to when I actually get paid.

The best loan isn’t always the cheapest one. It’s the one that fits your business rhythm. If you make steady money every day, daily payments might work fine and save you on interest. If your income comes in chunks, monthly payments make more sense even if they cost a bit more.

Conclusion

Short term business loans can be a lifeline when you need money fast. They’re quicker and easier than traditional bank loans, but they cost more too.

The key is knowing when to use them. They’re perfect for emergencies, buying inventory, or grabbing quick opportunities. They’re not good for long-term investments or things that won’t make money right away.

Before you apply, check your credit score. Get your documents ready. Know exactly how much you need and how you’ll pay it back. Compare multiple lenders – don’t just grab the first offer.

Remember what we covered: look at the total cost, not just the interest rate. Make sure the payment schedule fits your cash flow. Read all the fees before you sign.

Most importantly, borrow only what you need. A loan helps your business grow, but too much debt can sink you. Be smart, plan carefully, and these loans can help you build something amazing.