Table of Contents

Paying off your car loan early could save you hundreds or even thousands of dollars in interest. But how do you figure out exactly how much you’ll save? That’s where our auto loan payoff calculator comes in handy, it shows you in seconds how making extra payments affects your loan and puts money back in your pocket.

With car loans averaging $28,000 to $35,000 in today’s market, even small adjustments to your payment strategy can result in significant savings.

Our calculator eliminates the guesswork by instantly calculating your monthly payment, total interest costs, payoff timeline, and exact savings potential.

Whether you’re planning to pay an extra $50 per month or considering refinancing to a lower rate, this tool gives you the clarity you need to make confident financial decisions about your vehicle financing.

How to Use This Car Loan Payoff Calculator (Step-by-Step Guide)

Using our car loan calculator is simple! Just follow these steps to see how much you can save by paying off your auto loan early:

- Enter your loan amount – Type in the total price of the vehicle you’re financing (for example, $25,000)

- Add your interest rate – Input your annual interest rate as an APR percentage (for example, 5.5%)

- Set your loan term – Choose whether you want to enter the term in months or years using the toggle button, then enter the length (for example, 60 months or 5 years)

- Enter your down payment – If you made an upfront payment, add that amount here (optional)

- Add extra monthly payments – Type in any additional amount you plan to pay each month ($100 in an example)

- Click Calculate – Hit the calculate button to see your results instantly.

I recently used this calculator when deciding whether to put my tax refund toward my car loan. By entering just $75 extra per month, I was shocked to see I could shave nearly 8 months off my loan and save over $500 in interest.

Once you’ve entered all your information, the calculator will show you exactly how much faster you’ll pay off your loan and the total interest savings you’ll enjoy.

If you are thinking about financing something other than a car? You can also use our ATV Loan Calculator to estimate payments for your all-terrain vehicle and plan your payoff strategy.

Understanding Your Calculator Results

Monthly Payment Estimate

Your monthly payment estimate appears at the top of the results. This shows what you’ll pay each month with your regular payment. In our example with a $25,000 loan at 5.5% interest over 60 months, your base payment would be around $470. This is the standard payment amount needed to pay off the loan on schedule.

Total Loan Cost Breakdown

The results display your total interest paid and total amount paid over the life of the loan. These numbers change dramatically when you add extra payments. With regular payments, you might pay a certain amount in interest, but with that extra monthly payment, you’ll pay significantly less, showing your real savings potential.

Payoff Time Saved

When you add extra monthly payments, the calculator shows how many months earlier you’ll be debt-free. This is one of the most motivating numbers—seeing your payoff date move up by months or even years makes the extra payments feel worthwhile.

Interest Savings

The calculator displays exactly how much interest you’ll save by making extra payments. This is the real-world impact of your financial commitment—turning that extra $100 per month into hundreds of dollars in savings.

Loan Summary

A comprehensive breakdown shows you all the key details:

- Your vehicle price

- Down payment amount

- Loan term in both months and years

- Interest rate (APR)

This summary gives you a complete picture of your financing situation at a glance.

How to Make the Most of This Calculator

Our car loan calculator is more than just a simple tool—it’s your financial planning ally. Here’s how to squeeze every drop of value from it:

Try Different Extra Payment Amounts

Don’t just enter one number and call it a day. Try several different additional payment amounts to find your sweet spot. Start by testing what adding $25 would do, then try $50, then $100, or $150. Each increase shows you more interest savings, helping you decide what you can realistically afford.

Find Your Maximum Savings Potential

Experiment with various extra payment scenarios to see how they affect your payoff timeline and total interest costs. You might discover that even small increases in your extra payment make a big difference over time.

Create “What If” Scenarios

Play with different interest rates to see what refinancing might save you. If you’re considering refinancing your loan, adjust the interest rate in the calculator to see exactly how much a lower rate would benefit you. This helps you determine whether refinancing is worth pursuing.

Compare Different Loan Terms

Use the month/year toggle to explore different initial loan terms. See how a 36-month loan compares to a 60-month loan, or a 5-year term versus a 7-year term. This helps you understand the trade-offs between monthly payment amounts and total interest paid.

If you’re buying a utility vehicle for work or recreation, our UTV Loan Calculator helps you compare loan terms and find the most affordable payment plan.

Save Your Results

After finding a plan that works, take a screenshot or write down your amortization details. This becomes your roadmap to freedom from car debt. Keep your results as a reminder of how each extra payment brings you closer to owning your car outright.

Next Steps for Auto Loan Early Payoff

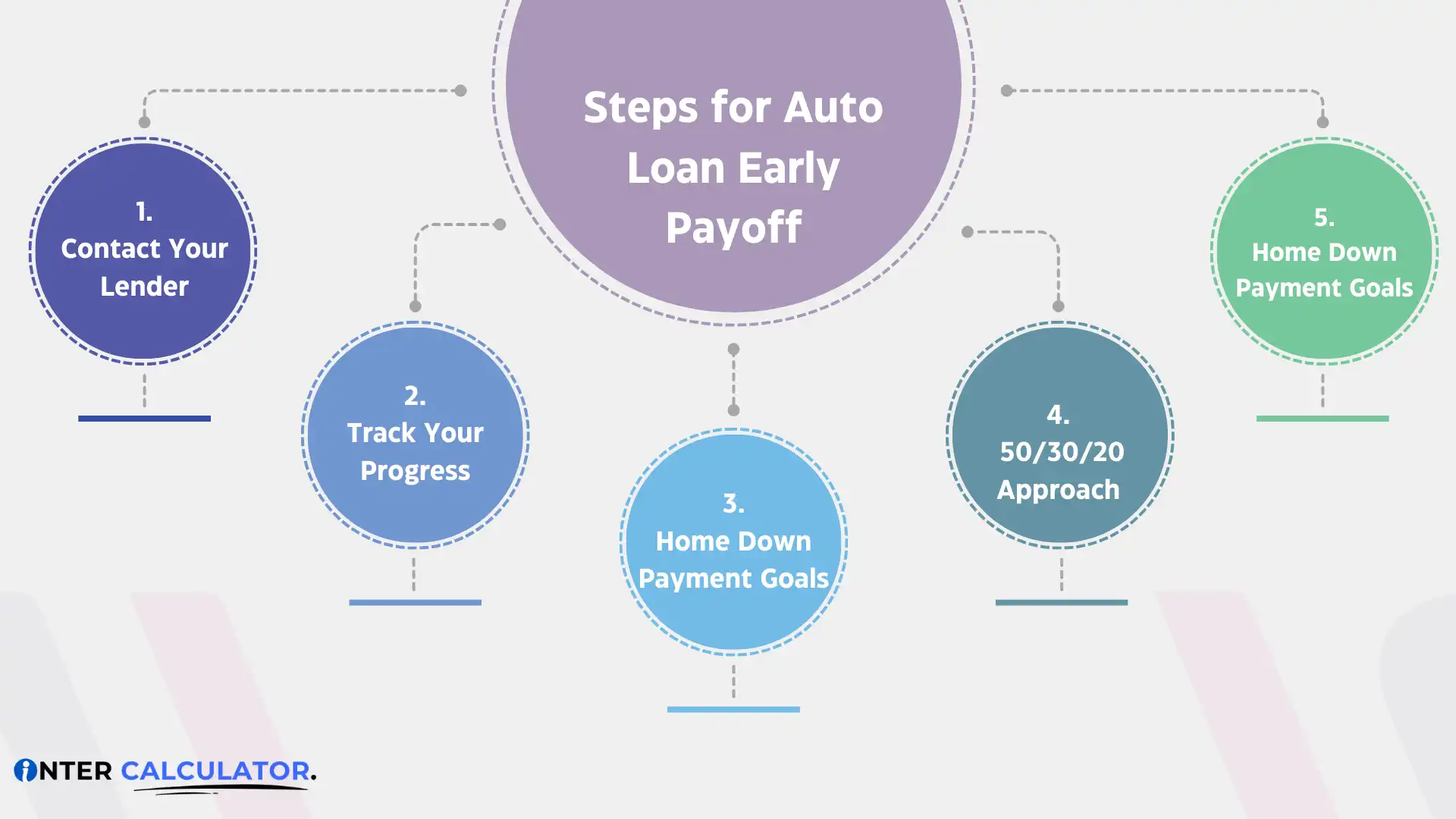

Now that you’ve used the car loan payoff calculator and see the potential savings, it’s time to put your plan into action. Here’s what to do next:

Contact Your Lender

Call your auto loan provider and confirm they accept extra payments without penalties. Ask specifically how to make sure additional payments go toward the principal balance, not future interest. When I called my lender, I discovered I needed to write “apply to principal” on my check memo line, a small detail that makes a big difference!

Set Up Automatic Extra Payments

Make your plan stick by setting up automatic payments for your new amount. Most online banking systems let you schedule recurring transfers. Set yours up to transfer your regular payment plus your extra amount on the same day each month, which removes the temptation to skip the extra payment.

Check for Prepayment Penalties

Some loans have prepayment penalties that can eat into your savings. Review your loan agreement or ask your lender directly. If your loan does have penalties, calculate whether your interest savings will still outweigh these costs using the calculator.

Track Your Progress

Every few months, check your loan balance against your projected payoff date. This keeps you motivated as you watch your balance drop faster than originally scheduled. Consider creating a simple chart where you track each payment—seeing that visual progress keeps you excited about sticking to your plan.

Choosing the Right Loan Term

The length of your auto loan dramatically impacts both your monthly payment and the total interest you’ll pay. Here’s a comparison based on a $25,000 loan at 6% interest:

| Loan Term | Monthly Payment | Total Interest | Total Cost |

|---|---|---|---|

| 36 months | $772 | $2,792 | $27,792 |

| 48 months | $594 | $3,512 | $28,512 |

| 60 months | $495 | $4,700 | $29,700 |

| 72 months | $426 | $5,672 | $30,672 |

| 84 months | $378 | $6,752 | $31,752 |

When I bought my first car, I was tempted by the lower monthly payments of a 72-month loan. But after using a calculator, I realized I’d pay nearly $3,000 more in interest compared to a 48-month term. I chose the 48-month option and tightened my budget elsewhere instead.

Finding Your Sweet Spot

The ideal loan term balances affordable monthly payments with reasonable total costs. While the 36-month term saves the most interest, the $772 payment might strain many budgets.

Try this approach: Start with the shortest term you can comfortably afford, then use the payoff calculator to see how adding even small extra payments might help you save interest while keeping your initial payment manageable. For my current car, I chose a 60-month term but pay an extra $50 monthly. This gives me the security of a lower required payment if money gets tight, while still saving me about $1,200 in interest compared to the standard 60-month plan.

Balancing Early Payoff with Other Financial Goals

Paying off your car loan early is exciting, but it needs to fit within your broader financial picture. Here’s how to balance car debt with your other money goals:

Emergency Fund Comes First

Before throwing extra money at your auto loan, make sure you have 3-6 months of expenses saved. I learned this lesson the hard way when I was aggressively paying down my car and then faced an unexpected job loss. With no emergency fund, I had to use credit cards for expenses, costing me much more than my car loan’s interest rate.

High-Interest Debt Takes Priority

If you have credit card debt or personal loans with higher interest rates than your car loan, tackle those first. The math is simple: paying off a 16% credit card saves you more than paying extra on a 6% car loan.

Retirement Contributions Matter

Don’t sacrifice retirement savings for a faster car payoff. If your employer matches 401(k) contributions, that’s an immediate 50-100% return, far better than the 4-7% you might save on your auto loan. Make sure you’re getting your full company match before putting extra toward your car.

Home Down Payment Goals

If you’re saving for a house down payment in the next few years, consider whether extra car payments might delay this bigger goal. Sometimes, keeping your car payment steady and saving the extra money gets you into a home faster, which could be financially smarter long-term.

The 50/30/20 Approach

Try using the 50/30/20 budget: 50% for needs, 30% for wants, and 20% for savings and debt payoff. Within that 20%, divide your money between different goals based on interest rates and timelines. This balanced approach has helped me make progress on multiple financial goals without feeling deprived.

Understanding Prepayment Penalties

Some car loans come with a nasty surprise if you try to pay them off early: prepayment penalties. These fees can take a big bite out of your potential interest savings, so it’s important to know what you’re dealing with.

What Are Prepayment Penalties?

A prepayment penalty is a fee charged by some lenders when you pay off your auto loan before the end of your loan term. Lenders include these penalties to make up for the interest they’ll lose if you pay early. These fees typically range from 1-3% of your remaining loan balance or a set number of months’ interest.

I almost got caught by this when I was ready to pay off my first car loan with a lump sum. Luckily, I checked my loan agreement first and discovered a 2% penalty that would have cost me nearly $300!

How to Check if Your Loan Has Penalties

Look for prepayment penalty language in your original loan agreement; it’s usually in the fine print under terms like “prepayment,” “early payoff,” or “additional payments.” If you can’t find your paperwork, call your lender directly and ask these specific questions:

- Does my loan have any prepayment penalties?

- How much is the penalty?

- Does it apply to extra payments or only to paying off the entire loan?

- Does the penalty decrease over time?

Calculating if Early Payoff Still Makes Sense

Even with a penalty, early payoff might still save you money. Use the car loan payoff calculator to see your potential interest savings, then subtract the prepayment penalty amount. If the result is positive, early payoff still makes financial sense.

For my second car, I had a small 1% penalty, but my interest savings from paying off 18 months early were 4% of my loan, making early payoff worthwhile despite the penalty.

Why We Built This Calculator

At InterCalculator, we believe financial tools should be accessible to everyone. Our editorial team created this car loan calculator after hearing from countless readers struggling with auto debt and unsure how to take control of their financial future.

We noticed many existing calculators were either too complicated or didn’t provide enough actionable information. Some required financial knowledge that many everyday car owners don’t have, while others gave results without explaining what they meant or how to use them.

Our team spent months researching auto loan structures, speaking with financial advisors, and testing different calculation methods to create a tool that’s both powerful and easy to use. We wanted to show not just how much you could save by making extra payments, but also give you a clear picture of how your loan term would change and what your actual monthly payment would be.

According to the Federal Reserve Bank of New York, auto loan debt in the United States reached $1.66 trillion by mid-2025, highlighting just how many Americans could benefit from strategies to reduce their car payments and save on interest.

I personally used an early version of this calculator when deciding whether to put my tax refund toward my car loan or into savings. Seeing exactly how much I could save in interest and how many months earlier I’d be payment-free made the decision much clearer.

Our editorial team continues to refine this calculator based on user feedback and financial best practices. We’re committed to helping you make informed decisions about your car loan and take control of your financial journey.

Final Thoughts

Using a car loan payoff calculator is the first step toward financial freedom from your auto debt. By understanding how extra payments affect your loan term and interest savings, you’ve gained powerful knowledge that puts you in control of your financial future.

Whether you choose to make small extra monthly payments, adjust your loan term, or refinance to a better interest rate, you now have the tools to make smart decisions about your car loan. Remember that the best strategy fits your unique financial situation and goals.

I’ve seen firsthand how paying off my car loan early freed up money for other important goals and gave me a wonderful sense of accomplishment. Your journey to an early payoff date starts with a simple calculation and ends with the keys to your car fully in your hands, no strings (or loans) attached.

Frequently Asked Questions

Got questions? Our FAQs cover common topics about how our tools work, tips for accurate calculations, and guidance on using InterCalculator for everyday money decisions.

What is a Car Loan Payoff Calculator?

A car loan payoff calculator helps you find out how much you still owe on your car loan and how long it will take to pay it off. It also shows how extra payments can help you clear your loan faster.

How does this calculator work?

You just enter your loan balance, interest rate, monthly payment, and the number of months left. The calculator then figures out your remaining balance and total interest.

Does it include early payoff penalties or fees?

No, the calculator gives an estimate based on your input. If your lender charges early payoff fees, you’ll need to check your loan terms to include those.

Does it include early payoff penalties or fees?

No, the calculator gives an estimate based on your input. If your lender charges early payoff fees, you’ll need to check your loan terms to include those.

Why should I use a car loan payoff calculator?

This calculator was created by the InterCalculator Editorial Team, led by Haris Farooq (Formula & Development). Our team specializes in formula research, calculator logic, and technical development, ensuring each tool is accurate, fast, and easy to use.

View Editorial Team →Before publishing, every calculator goes through the InterCalculator Accuracy Review Process. For the Percent Off Calculator, we verify formulas against trusted retail pricing and percentage calculation standards. We test results across multiple shopping and discount scenarios to ensure accurate and practical outputs. All calculations are reviewed with an experienced pricing analyst to confirm accuracy, clarity, and reliability.

View Process →