When your business needs money fast, waiting weeks for a bank loan just won’t work. I remember when I had to cover emergency repairs for my delivery truck. The mechanic needed payment within two days, and my regular bank told me it would take three weeks just to review my application.

That day, I learned about fast funding business loans. These loans can get you money in 24 to 48 hours instead of weeks. Let me show you how they work and which one might help your business.

What Are Fast Funding Business Loans?

Fast funding business loans are loans that give you money quickly. While normal bank loans can take 30 to 90 days, fast loans often fund in one to three business days. Some even fund the same day you apply.

These loans work by using simple applications and quick approval steps. Online lenders check your business in hours, not weeks. You fill out a form, send a few documents, and get your money fast.

Why Business Owners Need Quick Funding

Business emergencies don’t wait. Your equipment breaks. You run out of inventory during your busy season. A big client wants to place an order, but you need to buy supplies first.

According to a study published by the Federal Reserve, 23% of small businesses face unexpected expenses they can’t cover with cash on hand. When these moments happen, fast funding keeps your business running.

I’ve seen businesses lose big opportunities because they couldn’t act fast enough. A bakery I know missed a wedding contract because they couldn’t buy the special equipment in time. Fast funding solves this problem.

How Fast Can You Really Get Funded?

The speed depends on which type of loan you choose. Here’s what you can expect:

- Same day funding: Merchant cash advances and invoice factoring can fund within hours if you apply early in the day.

- 24-hour funding: Many online lenders approve and fund term loans within one business day.

- 2-3 day funding: Equipment loans and business lines of credit usually take two to three days because lenders need to check the equipment or set up your credit line.

- One week funding: SBA Express loans are the fastest government-backed option, but they still take about one week or more.

The fastest option isn’t always the best option. Sometimes waiting an extra day or two can save you thousands in fees.

Top 5 Types of Fast Business Loans

Let me walk you through the five most popular fast business loans. Each one works differently and fits different needs.

Term Loans for Large Business Expenses

A term loan gives you one big payment upfront. You pay it back in fixed amounts each month, usually for one to five years. Before taking out a term loan, use a future value calculator to see what your total repayment will be over time.

These loans work best when you need a lot of money for one big expense. Maybe you’re buying new machinery, opening a second location, or doing a major renovation.

Online lenders can approve term loans in 24 to 48 hours. Traditional banks take longer but often give you better rates. According to the U.S. Small Business Administration, term loans range from $25,000 to over $5 million.

The good part: You get lots of money at once, rates are usually lower than other fast loans, and you know exactly what you’ll pay each month.

The hard part: You need good credit (usually 650 or higher) and steady monthly revenue. Some lenders want to see at least $10,000 coming into your business each month.

Business Lines of Credit for Flexible Needs

A business line of credit works like a credit card for your business. The lender approves you for a maximum amount, and you can borrow up to that amount whenever you need it.

You only pay interest on the money you actually use. If you have a $50,000 line of credit but only use $10,000, you only pay interest on $10,000.

I love lines of credit for businesses with changing needs. One month you might need $5,000 for inventory. The next month you might need nothing. You’re not stuck with a big loan when you don’t need money.

Most online lenders can set up a line of credit in two to three business days. Once it’s set up, you can get money the same day you ask for it.

These work great for covering cash flow gaps, seasonal inventory needs, and small, unexpected expenses. Just remember that rates can be higher than term loans, and credit limits are usually smaller (often under $100,000).

Same-Day and 24-Hour Funding Options

When you need money TODAY, these two options can help. They’re faster but come with higher costs.

Equipment Financing for Quick Asset Purchases

Equipment financing helps you buy business equipment. The equipment itself serves as the loan guarantee, which makes these loans easier to get and faster to process.

You can use this for trucks, computers, kitchen equipment, construction tools, and any other equipment your business needs.

The Federal Reserve’s Small Business Credit Survey shows that equipment financing is popular because it’s easier to get approved when you have bad credit. Lenders feel safer because they can take the equipment back if you don’t pay.

Most equipment lenders fund within one to three days. Some fund the same day. I once helped a friend get a food truck financed, and he had the money in his account 24 hours after he applied.

You can usually borrow up to 100% of the equipment cost. If you’re financing multiple pieces of equipment at different times, a stock average calculator can help you track the average cost of your equipment investments. Rates are lower than unsecured loans. But remember, if you can’t make payments, you lose the equipment you bought.

Invoice Factoring for Immediate Cash

If your business sends invoices to customers and waits 30, 60, or 90 days to get paid, invoice factoring can help you get that money faster.

Here’s how it works: A factoring company buys your unpaid invoices. They give you about 80-90% of the invoice value right away. When your customer pays the invoice, the factoring company gives you the rest minus their fee.

This isn’t really a loan. You’re selling your invoices. But it gets you cash fast when you need it.

According to the International Factoring Association, factoring fees usually run from 1% to 5% of each invoice. So if you factor a $10,000 invoice with a 3% fee, you’d pay $300. If you’re considering factoring multiple invoices over time, a dividend calculator can help you track your regular cash flows and plan accordingly.

The good part: You can get money the same day, no credit check needed, and you can factor as many or as few invoices as you want.

The hard part: It costs more than loans, your customers know you’re using factoring, and you need reliable customers who pay their invoices on time.

How to Qualify for Fast Business Funding

Getting approved for fast funding is easier than getting a traditional bank loan, but you still need to meet certain requirements.

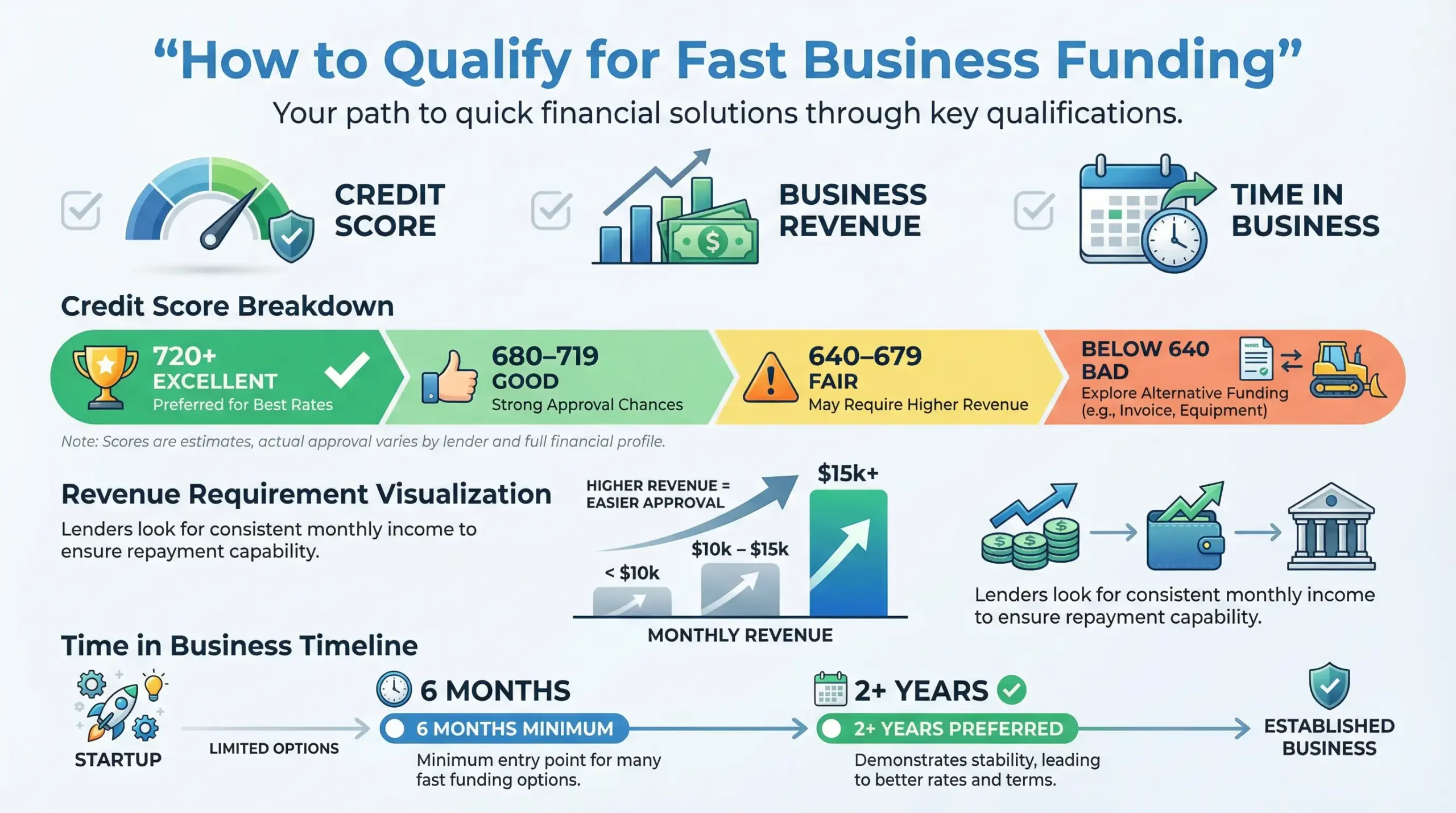

Credit Score and Revenue Requirements

Most fast business lenders look at two main things: your credit score and your business revenue.

For credit scores, here’s what different lenders typically want:

- Excellent credit (720+): You qualify for almost anything with the best rates.

- Good credit (680-719): You can get most loans but might pay slightly higher rates.

- Fair credit (640-679): Online lenders and alternative options still work. Rates go up.

- Bad credit (below 640): You can still get merchant cash advances, invoice factoring, or secured equipment loans.

For revenue, most lenders want to see monthly sales of at least $10,000 to $15,000. Some want more. Invoice factoring and merchant cash advances care more about your revenue than your credit score.

Time in business matters too. Most lenders want you to have been open for at least six months. Some want two years. Startups have fewer options and higher rates.

Documents You Need to Apply

Fast loans need less paperwork than bank loans, but you still need to show some documents.

Here’s what most lenders ask for:

- Business bank statements: Usually the last three to six months. This shows your real revenue.

- Business tax returns: Some lenders want one or two years of returns. Others don’t need any.

- Personal ID: Driver’s license or passport to prove who you are.

- Business information: Your business address, how long you’ve been open, what you sell.

Some lenders might also want to see:

Proof of ownership (like LLC papers), recent invoices if you’re factoring, or equipment details if you’re financing equipment.

The faster the loan, usually the less paperwork they need. Merchant cash advances might only need bank statements. SBA loans need much more.

Have these documents ready before you apply. It speeds up the whole process. I keep digital copies in a folder on my computer so I can apply for funding in minutes when I need to.

SBA Express Loans vs Online Lenders

People often ask me if they should go with an SBA loan or an online lender. Both have good points. Let me break it down.

When to Choose SBA Express Loans

SBA Express loans are the fastest SBA option, but they’re still slower than most online lenders. According to the Small Business Administration, you can get approved in 36 hours, but funding takes longer.

The big benefit: Lower rates and bigger amounts. SBA Express loans go up to $500,000 with rates that are usually 2-4% lower than online lenders.

Choose SBA Express when:

You can wait one to two weeks for money. You need a large amount ($100,000+). You want the lowest possible rate. You’re buying real estate or making a major investment.

Skip SBA Express if you need money in 24-48 hours or if you don’t meet their strict requirements. They want good credit, solid revenue, and a detailed business plan.

Benefits of Online Business Lenders

Online lenders are my go-to when I need speed. They use technology to make decisions fast. No waiting for a banker to review papers on their desk.

Here’s why online lenders work well:

- Speed: Many fund within 24 hours. Some even do same-day funding.

- Easy application: Everything happens online. No appointments, no meetings.

- Flexible requirements: They accept lower credit scores and newer businesses.

- Simple paperwork: Most just need bank statements and basic info.

I’ve used online lenders three times for my business. Each time, I had money in my account within two days. The application took about 15 minutes.

The tradeoff is cost. Online lenders charge higher rates than SBA loans. But when you need money fast, that extra cost is worth it.

Cost of Fast Business Loans

Let’s talk about money. Fast loans cost more than slow loans. That’s just how it works. But understanding the costs helps you make smart choices.

Interest Rates and Fees to Expect

Interest rates vary a lot based on the type of loan and your business.

Here’s what different loan types typically charge:

- Term loans: 7% to 30% APR. Good credit gets you closer to 7%. Bad credit pushes you toward 30%. Use a compound interest calculator with withdrawals to understand how interest accumulates on your loan and plan your payment strategy.

- Business lines of credit: 10% to 80% APR. Yes, really. The high end is for risky borrowers.

- Equipment financing: 8% to 30% APR. Lower rates because the equipment is collateral.

- Merchant cash advances: Not measured in APR, but the effective cost can equal 40% to 200% annual rate.

- Invoice factoring: 1% to 5% per invoice per month. If an invoice takes 60 days to pay, you might pay 2-10% total.

- Besides interest, watch for these fees:

- Origination fees: Usually 1% to 5% of the loan amount, taken out when you get the money.

- Processing fees: Some lenders charge $100 to $500 just to process your application.

- Early payment fees: Some loans charge you for paying off early. Always check this.

According to Bankrate’s business loan data, the average small business loan rate is around 11.5%, but this varies widely.

How to Get the Best Rates

You can’t always get the lowest rate, but you can improve your chances.

| Tip | What It Means | Why It Helps |

|---|---|---|

| Improve Your Credit Score | Pay bills on time, lower credit card balances, and fix errors on your credit report. Every 20 points matters. | A higher score reduces risk for lenders and unlocks better rates. |

| Show Strong Revenue | Keep accurate, up-to-date financial records that clearly show business income. | Strong revenue makes your business look safer to lenders. |

| Compare Multiple Lenders | Get quotes from at least 3 lenders (5–6 is even better). Don’t accept the first offer. | Comparing options helps you avoid overpaying. |

| Consider Slightly Slower Options | Waiting 2–3 days instead of same-day funding can save 5–10% on rates. | Speed costs money; patience lowers borrowing costs. |

| Put Up Collateral | Use an asset to secure the loan instead of borrowing unsecured. | Secured loans usually come with lower interest rates. |

| Borrow Less | Only take the amount you actually need. | Smaller loans often qualify for better terms. |

| Understand the Trade-Off | Fast and cheap rarely go together in business loans. | Knowing this helps you shop smart and avoid bad deals. |

Fast Funding for Bad Credit Businesses

Having bad credit doesn’t mean you can’t get funding. It just means you need to know which options work for you.

Alternative Options When Banks Say No

Banks turn down businesses with credit scores below 640. But alternative lenders specialize in working with bad credit borrowers.

Here are your best options:

| Financing Type | What Lenders Care About | Typical Qualification |

|---|---|---|

| Revenue-Based Financing | Monthly sales revenue more than credit score. | $20,000+ per month in revenue can qualify. |

| Equipment Financing | Equipment itself serves as collateral, reducing risk. | Possible approval with credit scores around 580. |

| Invoice Factoring | Your customers’ payment history, not your credit. | Can work even with 500 credit score if customers pay on time. |

| Merchant Cash Advances | Volume of card sales rather than credit score. | Usually need $5,000+ in monthly card sales. |

The rates will be higher than what people with good credit pay. That’s just reality. But when you need money to keep your business alive, higher rates beat no money at all.

Use these options to solve immediate problems. Then work on improving your credit so you can get better terms next time.

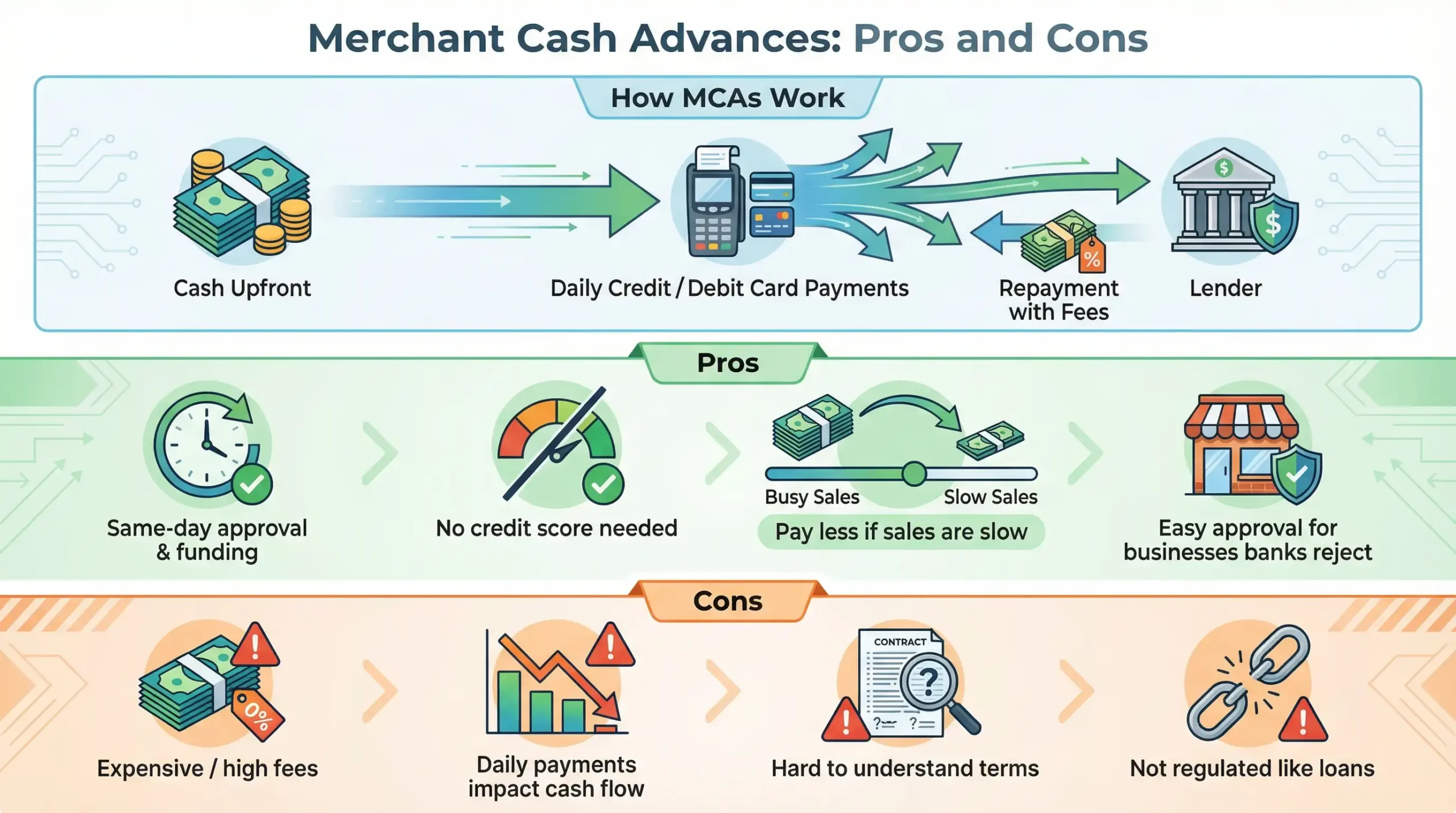

Merchant Cash Advances: Pros and Cons

Merchant cash advances (MCAs) are one of the fastest funding options. They’re also one of the most expensive. You need to understand both sides.

- How MCAs work: You get money upfront. Then the MCA company takes a percentage of your daily credit and debit card sales until you’ve paid back the advance plus fees.

- The good parts: You can get approved and funded the same day. No credit score requirements in most cases. If sales are slow, you pay less that day. Easy approval for businesses that banks reject.

The hard parts:

Very expensive – costs can equal 40% to 200% per year. You pay every single day you have card sales. Can hurt cash flow if your margins are tight. Some MCA companies are aggressive if you miss payments.

I only recommend MCAs for true emergencies. Use them when you’ll lose more money by not having the funds than you’ll pay in MCA fees.

For example, if a $10,000 MCA costs you $2,500 in fees but helps you complete a $20,000 project, it might make sense. But don’t use an MCA to buy regular inventory or cover routine expenses.

Conclusion

Fast funding business loans give you quick access to money when your business needs it. You have many options, from same-day merchant cash advances to one-week SBA Express loans.

The key is matching the right loan to your situation. Need money today for emergency repairs? Invoice factoring or merchant cash advances work. Want the best rate and can wait a week? SBA Express loans save you money. Building credit and need flexibility? A business line of credit gives you both.

Remember that speed costs money. Faster loans charge higher rates. But sometimes paying more is worth it to save your business or catch a big opportunity.

Before you apply, check your credit score, gather your documents, and compare at least three lenders. Know exactly how much you need and how you’ll pay it back. Fast funding is a tool, and like any tool, it works best when you use it right.

Your business is worth protecting. When you need money fast, now you know exactly where to find it.