Table of Contents

Compound interest is like magic for your money. Put $1,000 in a savings account today, and it could grow to $2,653 in 20 years without you adding a single penny more.

I remember when my friend Jane started saving $50 every month at age 25. She didn’t think much of it back then. But when she turned 45, her savings account had grown to over $35,000. The secret? Compound interest did most of the heavy work for her.

Our compound interest calculator helps you see exactly how your money can grow over time. You just enter your starting amount, interest rate, and how long you want to save. Then watch the magic happen.

Whether you’re planning for retirement, saving for a house, or just want to grow your money, this tool shows you the real power of starting early. The compounding effect means you earn money on your money, then earn money on that money too.

Let’s see how much your savings could grow.

How to Use Our Compound Interest Calculator

Our compound interest calculator makes it super easy to see how your money can grow. I’ve used this type of tool myself many times when planning my savings goals.

Just follow these simple steps to get your results.

Required Input Fields

- Pick your currency from the buttons at the top. You can choose dollars ($), euros (€), pounds (£), rupees (₹), yen (¥), or other currencies.

- Enter your initial savings balance in the first box. This is how much money you’re starting with today. Even if it’s just $100, that’s perfectly fine.

- Add your interest rate in the percentage box. This is the yearly rate your bank or investment gives you. Most savings accounts give 1-5% per year.

- Choose how long you want to save. Enter the years in the first time box and months in the second box. Want to save for 5 years? Just put “5” in years and “0” in months.

Optional Settings

- Add regular contributions if you plan to save more money each month or year. Many people save $50 or $100 every month. Leave this blank if you won’t add more money.

- Pick how often you’ll make these contributions from the dropdown menu. You can choose monthly, quarterly, half-yearly, or yearly.

- Choose your compounding frequency from the dropdown. This shows how often your interest gets added to your balance. Most banks do this monthly.

- Turn on the inflation toggle if you want to increase your monthly savings each year to keep up with rising prices.

- Hit the “Calculate” button when you’re ready. You’ll see exactly how your money will grow over time in a nice table below.

What is Compound Interest?

Compound interest is when you earn money on your original savings and also on the interest you’ve already earned. It’s like your money making money, and then that new money makes even more money. The longer you save, the faster your money grows because each year you’re earning interest on a bigger amount than before.

Compound Interest Formula and Calculation

Compound interest uses a simple math formula that shows exactly how your money grows. I’ve broken it down so anyone can understand it.

The main formula looks scary at first, but it’s actually pretty easy once you see what each part means.

The Mathematical Formula

The compound interest formula is:

Here’s what each letter means:

- A = the final amount you’ll have

- P = your starting money (principal)

- r = your interest rate (as a decimal, so 5% = 0.05)

- n = how many times per year interest gets added

- t = number of years

Let me show you with real numbers. Say you start with $5,000 at 5% interest for 3 years, compounded monthly (12 times per year).

A = 5,000(1 + 0.05/12)^(12×3)

A = 5,000(1.004167)^36

A = 5,000 × 1.161

A = $5,805

So your $5,000 grows to $5,805 in 3 years.

If you want to see different scenarios? You can try our Future Value Calculator for flexible inputs.

Different Compounding Frequencies

The more often your interest gets added, the more money you make.

Daily compounding means interest gets added 365 times per year. Monthly compounding adds it 12 times. Yearly compounding only adds it once.

With our $5,000 example above:

- Daily compounding: $5,809

- Monthly compounding: $5,805

- Yearly compounding: $5,788

The difference isn’t huge, but daily compounding always wins. That’s why many high-yield savings accounts compound daily – it helps your money grow faster.

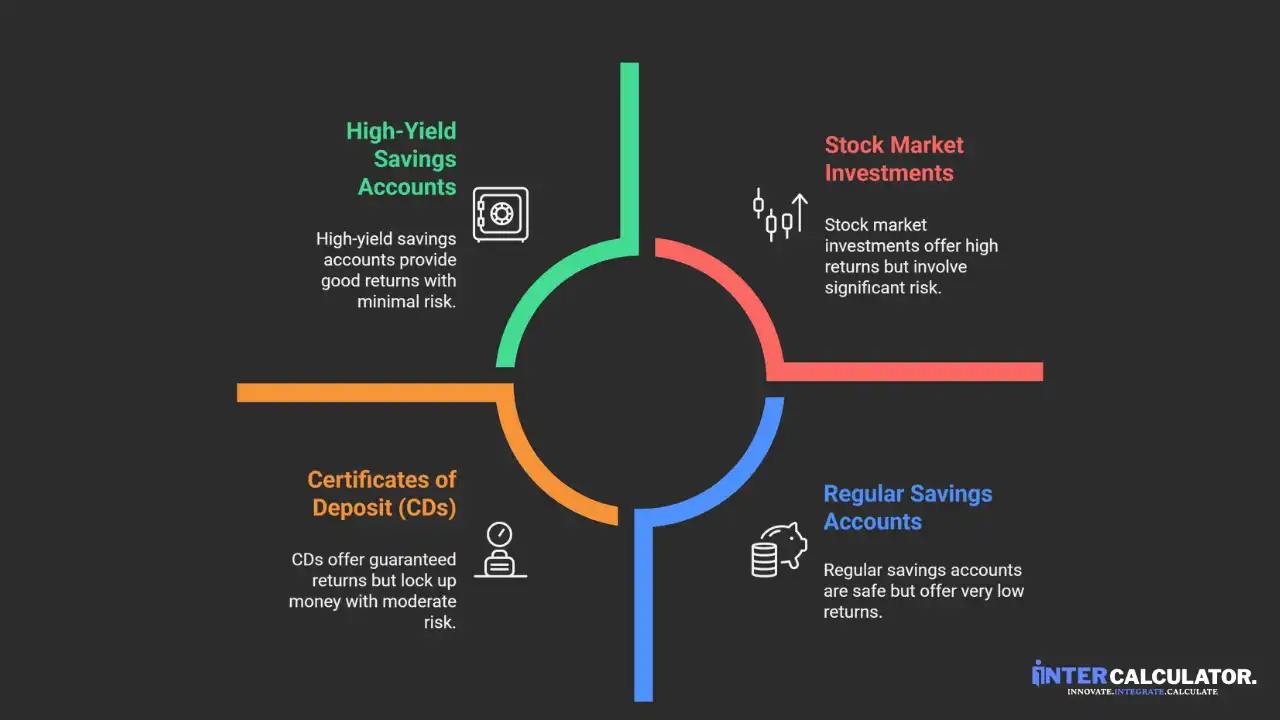

Where to Invest for Compound Interest

Finding the right place to grow your money with compound interest is easier than you think. You just need to pick the safe or growth options that match your goals.

Safe Investment Options

High-yield savings accounts

These are perfect for keeping your money safe while it grows. According to Fortune, these accounts currently offer up to 5.00% APY as of November 2025, which is much better than regular savings accounts that only pay around 0.40%.

Certificates of deposit (CDs)

Certificates of deposit (CDs) lock in your interest rate for a set time. According to Fortune, the best CD rates in November 2025 offer up to 4.20% APY. You can’t touch your money during the term, but you know exactly what you’ll earn.

Money market accounts

These accounts give you the best of both worlds – higher rates plus easy access to your cash. According to Yahoo Finance, top money market accounts currently offer rates above 4.25% APY as of November 2025.

Growth Investment Options

Stock market investments

Stock market investments can grow much faster over time. According to Trade That Swing, the historical average yearly return of the S&P 500 is 10.48% over the last 100 years. Recent data from RBC Wealth Management and SoFi shows the S&P 500 gained 25% in 2024, with long-term averages around 10% annually.

If you want to see how spreading out your purchases with dollar-cost averaging can impact your stocks? Give our Stock Average Calculator a try.

Retirement accounts

Retirement accounts like 401(k)s and IRAs use compound interest to build long-term wealth. According to CNBC, average 401(k) balances hit record highs of $144,400 in 2025, jumping 9% from the previous year based on Fidelity data. These accounts let your money grow tax-free for decades.

Mutual funds and ETFs

Mutual funds and ETFs let you spread your risk across lots of investments while still taking advantage of compounding. They’re especially great inside retirement accounts, where your money can grow tax-free for years. If you are curious about how dividends can give your returns a little extra boost? You can try our free Dividend Calculator.

Strategies to Maximize Compound Interest

The secret to building real wealth isn’t just saving money – it’s making your money work as hard as possible. I’ve learned that small changes in how you save can make huge differences over time.

Let me share the strategies that actually work.

Start Early and Stay Consistent

Time is your biggest advantage when it comes to compound interest. The earlier you start, the more your money can grow.

I wish someone had told me this when I got my first job at 22. If you save $200 every month starting at age 25, you could have over $500,000 by retirement. But wait until 35? You’d only have about $250,000.

Dollar-cost averaging

- Dollar-cost averaging means putting the same amount in every month, no matter what. This helps smooth out market ups and downs. When prices are high, you buy less. When they’re low, you buy more.

- Automation is key to staying consistent. Set up automatic transfers so money moves to your savings before you can spend it. Most high-yield savings accounts and retirement accounts let you do this easily.

| Starting Age | Monthly Savings | Final Amount at 65 |

| 25 | $200 | $525,000 |

| 35 | $200 | $263,000 |

| 45 | $200 | $118,000 |

Assumes 7% annual return with compound interest

Choose High-Yield Investment Accounts

Not all accounts are created equal. Where you put your money matters just as much as how much you save.

High-yield savings accounts should be your starting point. According to Fortune, these accounts offer up to 5.00% APY as of November 2025. compared to regular banks that pay almost nothing.

Here’s how different accounts stack up:

- High-yield savings: 4-5% APY, money stays safe and accessible

- CDs: 3-4% APY, money locked up but guaranteed returns

- Stock market investments: 10% average long-term, but can go up and down

- Retirement accounts: Tax advantages plus compound growth over decades

Risk vs return is always a trade-off. Safe options like savings accounts won’t make you rich, but they protect your emergency fund. Investment accounts can grow much faster, but your money can also lose value in bad years.

My personal strategy? Keep 3-6 months of expenses in a high-yield savings account for emergencies. Put long-term money in retirement accounts with stock investments for maximum compound interest growth.

Note: This information is based on my experience and research and is for educational purposes only. Please discuss your specific financial situation with a qualified financial advisor before making investment decisions.

Final Thoughts

Compound interest really is one of the most powerful tools for growing your money. Whether you start with $100 or $10,000, the key is to begin now and stay consistent.

Remember, time is your best friend when it comes to compounding. Even small amounts can grow into impressive sums if you give them enough years to work.

Start with our compound interest calculator to see how your savings could grow. Then pick the right accounts for your goals – high-yield savings for emergency funds and investment accounts for long-term wealth building.

The sooner you start, the more your future self will thank you.

Frequently Asked Questions

Got questions? Our FAQs cover common topics about how our tools work, tips for accurate calculations, and guidance on using InterCalculator for everyday money decisions.

How often should I check my compound interest calculator results?

Once or twice a year is enough. Compound interest works best when you leave your money alone to grow. Checking too often might make you want to change your strategy when you should stay consistent.

What's the minimum amount I need to start with compound interest?

You can start with as little as $1. Most high-yield savings accounts have no minimum balance. The important thing is to start now, even if it’s just $25 or $50 per month.

Is compound interest better than simple interest?

Yes, always. Simple interest only pays you on your original money. Compound interest pays you on your original money plus all the interest you’ve already earned. Over time, this makes a huge difference.

How long does it take to see real results from compound interest?

You’ll start seeing small gains right away, but the magic really happens after 10-15 years. That’s when your interest earnings start earning meaningful interest themselves.

Can I lose money with compound interest?

Compound interest itself doesn’t cause losses—it grows your money over time. However, if your investment or account is tied to assets that can decrease in value (like stocks), you could lose money despite compounding. Safe accounts like savings or fixed deposits typically won’t lose principal. Always consult with a financial expert before making investment decisions.

This calculator was created by the InterCalculator Editorial Team, led by Haris Farooq (Formula & Development). Our team specializes in formula research, calculator logic, and technical development, ensuring each tool is accurate, fast, and easy to use.

View Editorial Team →Before publishing, every calculator goes through the InterCalculator Accuracy Review Process. We verify formulas against trusted sources and test multiple datasets to ensure correct compound interest calculations. All results are reviewed with an experienced banking expert for accuracy and reliability.

View Process →