Table of Contents

If you’ve bought the same stock more than once at different prices, figuring out your real average cost per share can get confusing. A stock average calculator makes this simple by combining your total investment and quantity to show exactly what each share is costing you.

It’s a handy tool for any investor or trader who wants to track profit, manage risk, and plan smarter.

How to Use a Stock Average Calculator

Using a stock average calculator is easier than doing math homework. You just need two pieces of information: how many shares you bought and what price you paid for each batch. The calculator does all the heavy lifting and shows you your real cost per share.

How to Use Stock Average Calculator – Step by Step

Step 1: Enter First Stock Details

- Stock Symbol – Type the stock ticker (e.g., AMD, AAPL, TSLA)

- Current Stock Price – Enter today’s market price per share

- Purchase Price – Enter the price per share you paid

- Quantity – Enter the number of shares you bought

Step 2: Add More Stocks (Optional)

- Click the “+ Add More Stock” button

- A new form section will appear below

- Enter details for the next stock

- You can add as many stocks as needed

Step 3: Fill All Stock Forms

- Each new form will have its own fields

- All previously entered data will remain intact

- Fill in stock symbol, current price, purchase price, and quantity

Step 4: Click Calculate

- Once all stocks are entered, click the “Calculate” button

- This will calculate results for all stocks together

Step 5 View Results

Your results show for each stock:

- Total Shares – Combined shares you own

- Cost Basis – Average price per share

- Total Investment – Sum of all purchases

- Current Price – Today’s market price

- Portfolio Value – What your shares are worth now

- Profit/Loss – Gain or loss (green for profit, red for loss)

- Return % – Percentage return on investment

Pro Tips for Better Results

Always double-check your numbers before hitting calculate. One wrong digit can throw off your entire cost basis.

Keep your brokerage statements handy when using the calculator. You want the exact purchase price, not the rounded numbers you remember.

If you received shares through dividend reinvestment, count those as separate purchases at the price they were bought.

Most stock calculator average tools don’t include trading fees automatically. If you paid $10 per trade, add that to your purchase price for accuracy.

f you received shares through dividend reinvestment, count those as separate purchases at the price they were bought. You can also use our Dividend Calculator to see how dividends grow your portfolio over time

How Stock Average Calculators Work

These calculators use a simple math trick called weighted average – but don’t worry, you don’t need to understand the math to use them. Think of it like mixing paint: if you have more blue paint than red, the final color leans more toward blue. Same idea with stock prices.

The Magic Behind the Numbers

When you buy shares at different prices, each purchase has a different “weight” based on how many shares you bought. A stock average calculator considers both the price and quantity for each transaction.

Let’s say you bought 100 shares at $50 and 200 shares at $60. The calculator doesn’t just add $50 + $60 and divide by 2. That would give you $55, which is wrong.

Instead, it calculates your total cost ($5,000 + $12,000 = $17,000) and divides by your total shares (300). Your real average price is $56.67 per share.

The Simple Formula

Here’s what happens inside the calculator:

The calculator handles this formula instantly, even with 10 or 20 different purchases. No more scratching your head with a pencil and paper.

10 Common Mistakes to Avoid When Averaging Stock Prices

Even smart investors make costly mistakes when calculating their average stock price – and these errors can lead to poor trading decisions and tax problems. I’ve seen people lose thousands because they trusted wrong numbers or made simple calculation errors that threw off their entire investment strategy.

The Biggest Calculation Mistakes

1. Ignoring trading fees and commissions: Many investors forget to add $5-10 transaction fees to their cost basis, which throws off their true average price per share

2. Using simple averages instead of weighted averages: Just adding up prices and dividing by the number of purchases gives you wrong numbers when you bought different quantities

3. Forgetting about dividend reinvestment: Those automatic dividend purchases count as new transactions at different prices, but people often skip them in calculations

4. Mixing up dates and prices: Recording the wrong purchase date or price creates errors that compound over time, especially for tax reporting

5. Not tracking fractional shares: Modern brokerages let you buy partial shares, but rounding these to whole numbers messes up your average cost

Strategy and Timing Errors

6. Averaging down on failing companies: Using a stock average calculator to justify buying more shares of a bankrupt company is like calculating how to lose money faster

7. Emotional averaging without research: Buying more shares just because the price dropped, without checking if the company’s fundamentals still make sense

8. Averaging up at market tops: Adding to positions when stocks are clearly overvalued, thinking higher prices always mean more gains ahead

9. Ignoring position size limits: Letting one stock become too big a part of your portfolio through repeated averaging, which increases risk instead of managing it

10. Using outdated or wrong stock prices: Relying on delayed market data or misremembering prices when entering numbers into calculators

Always double-check your numbers, keep detailed records, and remember that a stock average calculator only works with accurate information – garbage in, garbage out.

Why We Built This Tool

We built this stock average calculator because we know how confusing it can feel when you buy the same stock many times at different prices. It’s easy to get lost in numbers, and sometimes that can make you worried or frustrated.

Our goal is to make investing simple and stress-free. This tool helps you see the true cost of your shares in one glance. It’s like having a friendly guide who does all the tricky math for you, so you can focus on making smart choices instead of worrying about mistakes.

We believe everyone, whether a beginner or an experienced investor, deserves a tool that makes their life easier and gives them confidence. With this calculator, you can track your investments, plan better, and feel calm knowing the numbers are correct.

Final Thoughts

A stock average calculator transforms complex investment math into simple decisions, helping you average down on quality stocks, average up on winners, and track your true cost basis for taxes. The secret isn’t just using the tool correctly—it’s understanding when to apply different averaging strategies while keeping accurate records of every purchase, fee, and dividend.

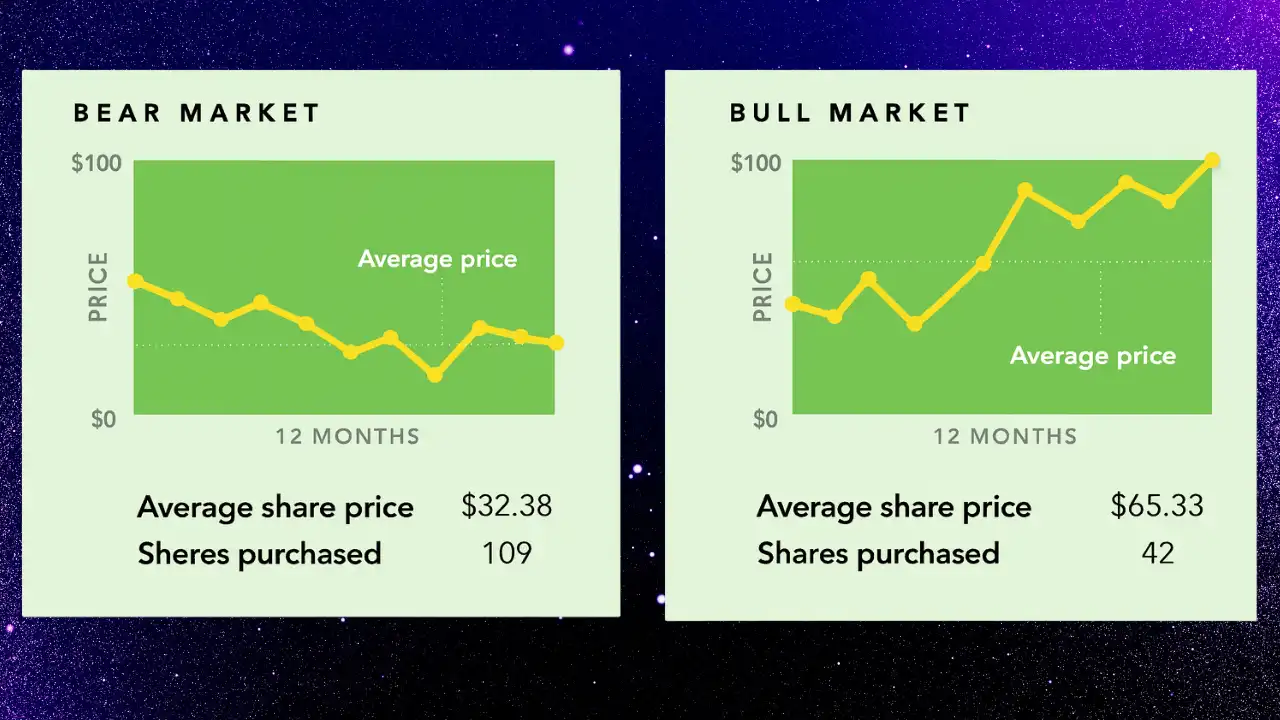

Whether you’re a passive investor using dollar-cost averaging or an active trader making strategic stock price averaging moves, these calculators give you the confidence to make rational decisions based on real numbers instead of emotions. This ultimately leads to better profits, smarter risk management, and peace of mind in any market condition.

You can also use our Future Value Calculator to estimate how your investments might grow over time.

Frequently Asked Questions

Got questions? Our FAQs cover common topics about how our tools work, tips for accurate calculations, and guidance on using InterCalculator for everyday money decisions.

How many stock purchases can I calculate?

Most stock average calculators let you add unlimited purchases – I’ve used some with 20+ transactions for single stocks without problems. Basic online calculators typically handle 5-10 entries, while advanced tools can process hundreds. If you’re a frequent trader or use dividend reinvestment, look for calculators with “add more” buttons that don’t limit your entries.

Can I use this for ETFs and mutual funds?

Absolutely! Stock average calculators work perfectly for ETFs, mutual funds, bonds, and any other securities you buy at different prices. The weighted average formula stays the same whether you’re calculating Apple stock or Vanguard ETF shares. Just enter your purchase prices and quantities like you would for individual stocks.

What about transaction fees and commissions?

Most basic calculators don’t include trading fees automatically – you need to add them manually. If you paid $10 per trade, add that to your purchase price before entering the numbers. So 100 shares at $50 plus $10 commission becomes $50.10 per share. Some advanced trading platforms include fees in their cost basis calculations automatically.

How accurate are online calculators?

Online calculators are extremely accurate for the math, they use the same weighted average formula that professional traders use. The accuracy depends on the data you enter. If you input correct prices, quantities, and fees, you’ll get precise results. Double-check your numbers before calculating, and always keep your own records as backup.

Can I export or save my calculations?

This calculator was created by the InterCalculator Editorial Team, led by Haris Farooq (Formula & Development). Our team specializes in formula research, calculator logic, and technical development, ensuring each tool is accurate, fast, and easy to use.

View Editorial Team →Before publishing, every calculator goes through the InterCalculator Accuracy Review Process. For this Stock Average Calculator, we verify formulas against trusted sources commonly used in equity trading, ensuring accurate cost-per-share and weighted average calculations. The tool is tested across multiple buying scenarios, including mixed entry points and varying share volumes. All calculations are reviewed with an experienced financial analyst to confirm accuracy, clarity, and reliability.

View Process →