Last year, my car’s transmission failed, and I had two options: a personal loan or a credit card. Both can help, but they work differently. A personal loan gives you fixed payments and lower rates; a credit card offers flexibility and rewards. In this guide, I’ll help you choose the right one for your situation, with simple comparisons and real examples.

Personal Loan vs Credit Card: Quick Comparison

Let me break down both options so you can see the differences fast.

What Is a Personal Loan?

A personal loan is a fixed-sum loan you borrow once and repay in equal monthly installments over a set period with a fixed interest rate. Typically between 1 and 7 years. It’s ideal for purposes like debt consolidation, home improvement, or major expenses, and can be either secured or unsecured based on your credit profile and income.

According to Investopedia, personal loans are commonly used for debt consolidation or home improvements.

What Is a Credit Card?

A credit card lets you make purchases using borrowed money from a bank, which you repay later. The bank pays the merchant on your behalf, and you get a monthly bill for what you spent. If you don’t pay the full amount by the due date, interest is added to the remaining balance.

Side-by-Side Comparison

| Feature | Personal Loan | Credit Card |

| Type of Credit | Installment loan (one-time) | Revolving credit (reusable) |

| How You Get Money | Lump sum all at once | Spend up to your credit limit |

| Interest Rate | Fixed (stays the same) | Variable (changes monthly) |

| Average APR | 6% to 36% | 20% to 28% |

| Payment Amount | Same fixed monthly payment | Changes based on balance |

| Loan Amount | $1,000 to $50,000 | Depends on your credit score |

| Repayment Time | 2 to 7 years | Pay the minimum or the full balance monthly |

| Can You Reborrow? | No one and done | Yes—pay it back, use it again |

| Best For | Big expenses, debt consolidation | Everyday purchases, small needs |

| Fees | Origination fee, late fees | Annual fee, balance transfer fee, late fees |

When to Use a Personal Loan

Not every money problem needs a personal loan. But in some situations, it’s honestly the smartest choice you can make.

Best Situations for Personal Loans

Big, one-time expenses are perfect for personal loans. Say your roof starts leaking and the contractor quotes you $15,000 for repairs. You need all that money upfront, not in small chunks. A personal loan gives you the lump sum right away, and you pay it back slowly over time.

Debt consolidation is another huge win. Let’s say you have three credit cards with balances:

-

Card 1: $5,000 at 24% APR

-

Card 2: $3,000 at 21% APR

-

Card 3: $2,000 at 19% APR

You’re juggling three payments and drowning in high interest. A $10,000 personal loan at 12% APR combines everything into one payment. You save thousands and know exactly when you’ll be debt-free.

Major purchases where timing matters also fit perfectly. Buying a car from a private seller? They want cash, not credit. Planning a wedding or handling medical bills? A personal loan with fixed payments helps you manage it without stress.

Here’s my rule: if you need $5,000 or more for something specific and can’t pay it off in six months, get a personal loan. The lower interest rate alone makes it worth it.

Personal Loan Benefits and Drawbacks

Every borrowing option has good parts and bad parts. Let’s be honest about both.

The Good Stuff:

-

Lower interest rates, usually 6% to 15% vs. 18% to 25% on credit cards.

-

Fixed payments make budgeting easy. My $246 monthly payment never changed.

-

Borrow larger amounts; some lenders go up to $50,000 or more.

-

No annual fees. You might pay an origination fee upfront, but nothing yearly.

-

Fast funding, many online lenders send money in 1 to 7 business days.

The Not-So-Good Stuff:

-

You can’t reborrow once it’s spent.

-

Origination fees can sting (1%–8% of the loan).

-

Good credit matters; a score above 670 gets better rates.

-

Less flexible than cards. Payments stay the same even if your month doesn’t.

When to Use a Credit Card

Credit cards get a bad reputation, but honestly? When used right, they’re amazing tools. Let me show you when they’re actually the smarter choice.

Best Situations for Credit Cards

-

Everyday purchases: groceries, gas, phone bills, streaming subscriptions. Perfect for earning rewards while paying for things you already buy.

-

Small to medium expenses (under $5,000): ideal for things like a $1,200 laptop or a $300 coffee maker replacement. Manageable to pay off within a few months without interest piling up.

-

0% APR offers: many cards offer 12–21 months interest-free on new purchases.

-

Building credit: responsible use grows your score fast.

-

Rewards and cash back: spending $2,000 monthly on a 2% cash back card earns $480 per year, or $2,400 in five years, just for using your card smartly.

-

Investing your rewards: if you invest those earnings, tools like our Stock Average Calculator help you track your average share cost.

-

Emergency backup: car battery dies, furnace quits, or any sudden cost. A $5,000 limit means you can handle it immediately and sort out payments later.

Personally, I treat my credit cards like short-term partners, not long-term debt. I use them for control, convenience, and cash back, never as extra income. Pay the balance monthly, and credit cards turn from financial traps into financial tools.

Cost Comparison: Which Is Cheaper?

Money talks, right? Let’s stop guessing and look at actual numbers. I’m going to show you exactly what each option costs in real dollars.

Interest Cost Examples with Real Numbers

Here’s where things get interesting. The same amount of money can cost you wildly different amounts depending on which option you pick.

If you want to see how your money grows over time? You can try our free Future Value Calculator to estimate how interest affects your total returns.

Scenario: You need $5,000

Let’s say your AC unit dies in summer and you need $5,000 fast.

Personal Loan Option:

- Loan amount: $5,000

- Interest rate: 10% (fixed)

- Loan term: 3 years

- Monthly payment: $161

- Total paid: $5,796

- Interest cost: $796

Credit Card Option:

- Balance: $5,000

- Interest rate: 20% APR (variable)

- Minimum payment: 2% of balance (around $100 first month)

- Time to pay off: About 7 years (if only paying minimums)

- Total paid: $8,632

- Interest cost: $3,632

Wait, what? That’s $2,836 more just in interest with the credit card. Same money, but you pay almost $3,000 extra because of that higher rate.

That’s $2,836 more in interest with the credit card—same $5,000 borrowed, but you pay almost $3,000 extra just because of the higher rate.

Credit cards usually charge daily compound interest, meaning you pay interest on top of interest when you don’t clear the balance.

I learned this the hard way. Years ago, I put $4,200 in car repairs on my card. Paid minimums for two years. The interest alone cost me over $1,800. Never again.

Hidden Fees and Total Cost of Borrowing

Interest rates don’t tell the whole story. Let’s talk about the fees nobody warns you about.

Personal Loan Fees:

The biggest surprise is the origination fee. Most lenders charge 1% to 8% of your loan amount just to process your application.

Borrow $10,000 with a 5% origination fee? That’s $500 taken right off the top. You actually receive only $9,500, but you pay back the full $10,000 plus interest.

Late fees hurt, too. Miss a payment and you’ll pay $25 to $50. Some lenders charge even more.

Credit Card Fees:

- Annual fees range from $0 to $550. Basic cards? Usually free. Travel rewards cards or premium cards? Get ready to pay $95 to $550 per year.

- Balance transfer fees cost 3% to 5% of whatever you move. Transfer $5,000 to save on interest? You’ll pay $150 to $250 upfront.

- Cash advance fees are brutal, usually 3% to 5% plus a higher interest rate (often 25%+). Avoid these like the plague.

Here’s my advice: add up all the fees before you decide. A 10% personal loan with a 5% origination fee really costs closer to 12% to 13% in the first year.

| Cost Factor | Personal Loan | Credit Card |

| Average Interest Rate | 10% to 15% | 20% to 24% |

| Origination Fee | 1% to 8% of the loan | $0 (usually) |

| Annual Fee | $0 (usually) | $0 to $550 |

| Late Fee | $25 to $50 | $25 to $40 |

| Balance Transfer Fee | N/A | 3% to 5% |

| Cash Advance Fee | N/A | 3% to 5% + higher APR |

| $5,000 Borrowed (3 years) | ~$800 interest | ~$3,600 interest (minimum payments) |

| $15,000 Borrowed (5 years) | ~$5,000 interest | ~$23,000+ interest (minimum payments) |

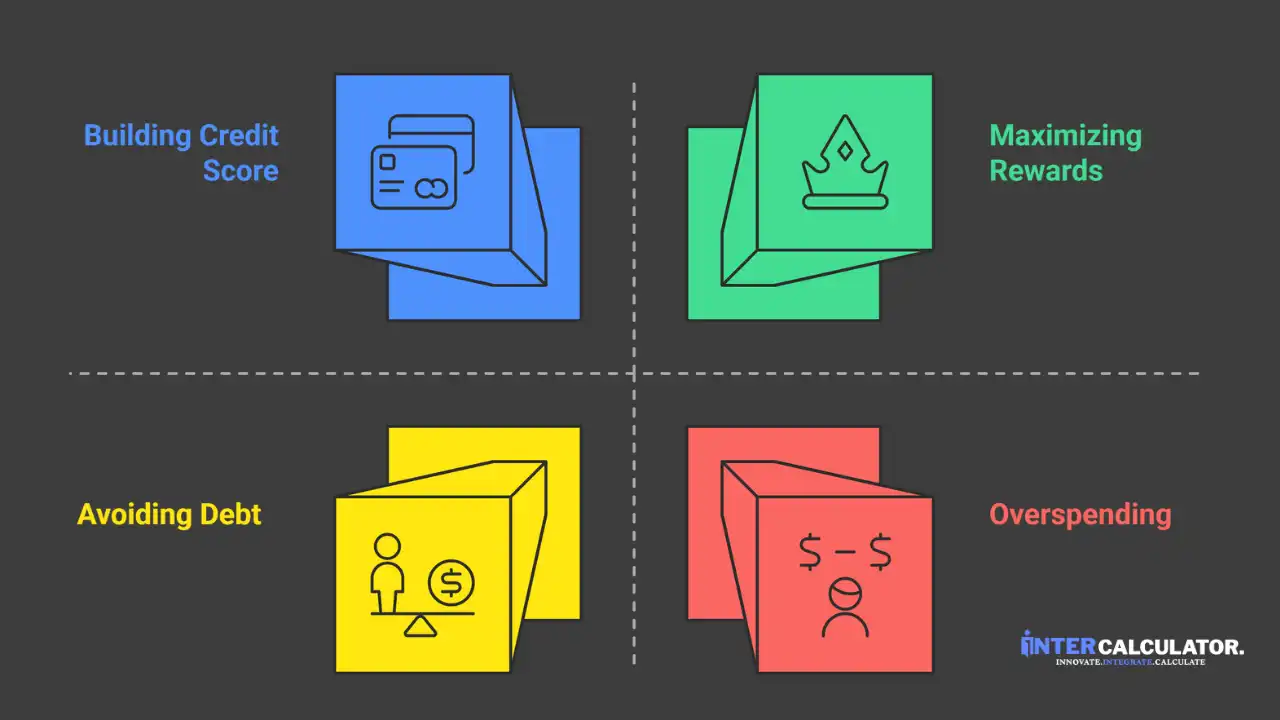

Common Mistakes to Avoid When Choosing

I’ve made some dumb money moves in my life. Let me save you from making the same ones.’

5 Common Personal Loan Mistakes

- Taking Longer Terms Than Needed

Longer terms mean smaller payments but a higher total cost. A seven-year $10,000 loan at 12% APR costs $4,500 in interest vs. $2,000 on a three-year term. - Not Comparing Lenders

Never take the first offer. I found a 9.5% loan after rejecting a 14% one, and saved over $1,200 just by checking two more lenders. - Ignoring Origination Fees

An 8% rate with a 6% fee isn’t really 8%. Always check the full APR including fees to see the true cost. - Borrowing More Than Needed

If you need $8,000 but get approved for $15,000, don’t take it all. You’ll just pay interest on money you don’t use. - Missing Prepayment Penalties

Read the fine print. My brother paid off his loan early and got hit with an $800 penalty. Avoid lenders that charge these.

6 Common Credit Card Mistakes

- Only Making Minimum Payments

A $5,000 balance at 22% APR can take 15 years to clear and cost $8,000 in interest. Always pay more than the minimum. - Ignoring Intro APR Expiration

0% offers end fast. Miss the deadline and you could jump to 24% interest overnight. Always mark the end date. - Taking Cash Advances

$500 cash advance = $25 fee + 25%+ interest from day one. No grace period, just expensive debt. - Maxing Out Your Limit

Using 90% of your credit limit can drop your score by 50–80 points. Keep usage under 30% to protect your credit. - Opening Too Many Cards Too Fast

Each new card lowers your score slightly. Space out applications by six months or more. - Not Using Rewards or Points

Unredeemed rewards = lost money. I once forgot 12,000 points worth $120. Check and use them before they expire.

Alternative Borrowing Options to Consider

Personal loans and credit cards aren’t your only choices. Sometimes other options fit better depending on your situation.

Home Equity Loans and HELOCs

Own a home? You might have another borrowing option hiding in your walls. These loans let you borrow against your home’s value.

For example, if your home is worth $300,000 and you owe $200,000, you’ve got $100,000 in equity. Banks usually lend up to 80% of that amount. Interest rates are lower, typically 6% to 9%, because your house is used as collateral.

That’s also the risk. Miss payments, and you could lose your home. These loans work best for big, meaningful expenses like home renovations or debt consolidation, not vacations or daily spending.

If you’re thinking long-term instead of borrowing, try our Dividend Calculator to see how much your investments could grow.

0% APR Financing

Retail store financing can be a smart move if you plan carefully. When I bought a couch, I got 0% APR for 24 months and paid it off before the promo ended. If you miss the deadline, though, they charge all the interest from day one.

This type of offer works best for specific purchases you know you can pay off quickly.

Buy Now, Pay Later Services

Buy Now, Pay Later platforms like Affirm, Afterpay, or Klarna split your purchase into four payments over six weeks, usually interest-free. They’re great for smaller purchases, say a $400 item, but can lead to overspending if used too often.

Personal Line of Credit

A personal line of credit works like a credit card but with lower interest rates, usually between 10% and 15%. You only pay interest on what you use, making it flexible and practical for ongoing expenses.

401(k) Loans

Borrowing from your 401(k) might sound tempting, but it’s usually a bad idea. You’ll lose potential investment growth, and if you leave your job, you may have to repay the loan within 60 days or face penalties.

Family Loans

Family loans can work well if treated seriously. Always write down the terms and set a repayment plan. I once borrowed $2,000 from my dad and paid him back $200 per month with 2% interest. He was happy, I saved money, and everyone won.

Final Verdict: Which Should You Choose?

After all these numbers and scenarios, you’re probably wondering—okay, but what should I actually pick?

Decision Framework Based on Your Situation

Let me make this super simple. Here’s exactly when to choose each option.

| Choose a Personal Loan If: | Choose a Credit Card If: |

| You need $5,000 or more for something specific (kitchen remodel, medical bill, car repair) | You need flexible borrowing under $5,000 and aren’t sure exactly how much you’ll need |

| You want predictable payments that never change each month | You can pay it off in 12 to 18 months max with aggressive payments |

| You can qualify for an interest rate under 15% (usually needs a credit score above 650) | You qualify for a 0% intro APR offer for 12 to 21 months |

| You’re doing debt consolidation of multiple high-interest debts | You want rewards on spending you’re doing anyway (2% cash back = $480/year on $2,000 monthly) |

| You need 3 to 5 years to pay it back with a fixed monthly payment | You have excellent credit (above 720) for best perks |

| You hate surprises and want to know your payoff date from day one | You’re disciplined enough to pay the full balance monthly |

| You’re borrowing for home improvements, major purchases, or emergency expenses | You’re using it for everyday purchases, small expenses, or building credit |

| Lower interest rates (6% to 15%) will save you thousands long-term | You can avoid interest completely by paying in full each month |

Next Steps to Apply

Ready to move forward? Here’s what to do right now.

| Step | What to Do | Why It Matters |

| 1. Check Your Credit Score | Get your free score from your bank or Credit Karma | Scores above 670 get good rates. Below 600? You might need a secured card or a bad credit loan |

| 2. Compare 3+ Options | Use prequalification tools for loans and cards | Checks rates without hurting your score. Don’t take the first offer you see |

| 3. Gather Documents | Personal loans: pay stubs, W-2s, bank statements. Credit cards: just income and address | Makes the application faster. Some lenders give same-day approval with proper docs |

| 4. Read All Terms | Look for origination fees, prepayment penalties, annual fees, and APR changes | Hidden fees can make a “good deal” expensive. Know when 0% APR ends |

| 5. Apply Once | Pick your best option and submit one application | Each application dings your credit score by 5 to 10 points. Space out applications by 6+ months |

Honestly? I use both. Personal loan for my $12,000 home renovation at 9.8% APR. Credit card for everything else, paid off monthly, earning $40 in cash back every month.

Pick what fits your situation. Need a big chunk of money? Personal loan. Need flexibility and can control yourself? Credit card.

You’ve got this.

Final Thoughts

Personal loans and credit cards both have their place; they just fit different needs. I’ve used personal loans when I needed a bigger chunk of cash, like $5,000 or more, for home repairs. The lower interest rate and fixed monthly payments made budgeting simple and stress-free.

Credit cards, on the other hand, are my go-to for everyday spending and short-term needs. I pay off my balance monthly, earn rewards, and never pay interest. The key is knowing your situation and using the right tool for it. Pick what fits your budget, stay disciplined, and you’ll stay in control of your money.

FAQs About Personal Loans vs. Credit Cards

1. Which is better for emergencies, a personal loan or a credit card?

If it’s a small emergency, like a $400 car repair, a credit card works fine (especially if you can pay it off quickly). For bigger emergencies, say $5,000 or more, a personal loan with fixed payments and lower interest is the smarter move.

2. Will applying for a personal loan hurt my credit score?

A little, yes, but only temporarily. The lender will do a hard credit check, which might drop your score by 5–10 points. Once you start making on-time payments, your score usually bounces back stronger.

3. Can I use a credit card for debt consolidation instead of a personal loan?

You can, but it depends on the offer. A 0% balance transfer card can save a ton in interest if you pay it off before the promo ends. Miss the deadline, though, and you’ll get hit with high rates again.

4. How do I know if I’ll qualify for a good loan rate?

Check your credit score first. Generally, a score above 670 gets decent rates (around 10–15%), and 740+ gets the best deals. Use a prequalification tool to compare offers without hurting your credit.

5. Should I use both a personal loan and a credit card?

Honestly, yes, if you use them wisely. I do. I took a personal loan for a home renovation, and I use my credit card for daily expenses that I can pay off monthly. The key is control: borrow smart, not often.