If someone offered you $10,000 today or $15,000 in 5 years, which would you take? Most people say “give me the money now.” But is that actually the smart choice?

The answer depends on the math. To follow along with the examples in this guide, open our Future Value Calculator in a new tab so you can run the numbers yourself as we go.

Here’s the thing. Money today is not the same as money later. A dollar in your hand right now can grow if you invest it. But a dollar promised to you in the future? You have to wait. And while you wait, inflation eats away at its value.

So which deal is better? The $10,000 now or $15,000 later? We’re going to run the actual numbers. You’ll see exactly how present value and future value work. And by the end, you’ll know which calculation to use when you’re making real money decisions.

Let’s start with the basics. What do these two terms even mean?

What Is Present Value (PV)?

Present value tells you what future money is worth right now. It’s a way to answer questions like: “If I get $15,000 in 5 years, what’s that really worth today?”

Think of it this way. You know that $100 today can grow into more money if you invest it using our Compound Interest Calculator. Well, present value flips that idea around. It asks: “How much money do I need today to end up with $15,000 later?”

This matters when someone promises you money in the future. A job offer with a bonus in 3 years. A lottery payout spread over 20 years. An investment that pays you back later. You need to know the real value now, not just the number they tell you.

How Present Value Works

Here’s how discounting works (which is essentially the reverse of compounding). Let’s say someone will pay you $1,000 next year. You want to know what that’s worth today.

You pick a discount rate. This is usually the interest you could earn if you invested that money yourself. Let’s say 5%.

Now you work backward. If you had $952 today and earned 5% interest for one year, you’d have $1,000. So the present value of $1,000 next year is $952 today. You can play with these numbers using our Discount Calculator to see how different rates affect the value.

The formula looks like this: PV = FV ÷ (1 + r)^n

-

PV = present value (what it’s worth now)

-

FV = future value (the money you’ll get later)

-

r = discount rate (as a decimal, so 5% = 0.05)

-

n = number of years

The longer you wait, the less that future money is worth today. Why? Because you lose the chance to invest it now and watch it grow.

What Is Future Value (FV)?

Future value tells you how much your money will grow over time. It answers questions like: “If I invest $1,000 today, what will I have in 10 years?”

This is the number most people care about. You want to know if your savings will be enough. If your investment will actually grow. If you’re on track to hit your goals.

Future value takes your money today and moves it forward through time. It shows you what happens when your money earns interest, and that interest earns more interest, and it keeps building on itself. If you are investing in stocks that pay out regularly, checking our Dividend Calculator can show you how reinvesting those payments accelerates this growth even further.

STOP READING AND TRY THIS: Don’t just read about it. Let’s see the “Snowball Effect” happen right now using the calculator . We are going to see what happens if you not only invest money once, but keep adding to it every month.

-

Go to the Future Value Calculator and Enter this exact data:

- Number of Periods (N): 30 (Years)

- Starting Amount (PV): $10,000 (Your current savings)

- Interest Rate (I/Y): 7% (Average stock market return; you can verify historical averages with our Stock Average Calculator)

- Compounding: Monthly (Standard for most accounts)

- Periodic Deposit (PMT): $500 (Monthly savings)

- PMT made at the: End of each compound period

Check the Result: You should see a total of $691,150.47. Not bad, but not a millionaire yet. Now, make ONE small change (The “Pro” Move): Change the Periodic Deposit (PMT) from $500 to $1,000. Check the New Result: It jumps to over $1,301,135.97. Notice that by doubling your monthly savings, you didn’t just double your result, you added over $600,000 in pure wealth.

Bonus Experiment (The “Hidden” Gain):

Keep the numbers the same, but change “PMT made at the” to Beginning. Notice the number jumps up by another $7,000+.

Why? Because investing at the start of the month gives your money 30 extra days to grow every single month for 30 years. Only a precision calculator like this can show you that hidden detail.

Key Differences Between Present Value and Future Value

Now that you know what each one means, let’s talk about how they’re different. And more important, when you should use each one.

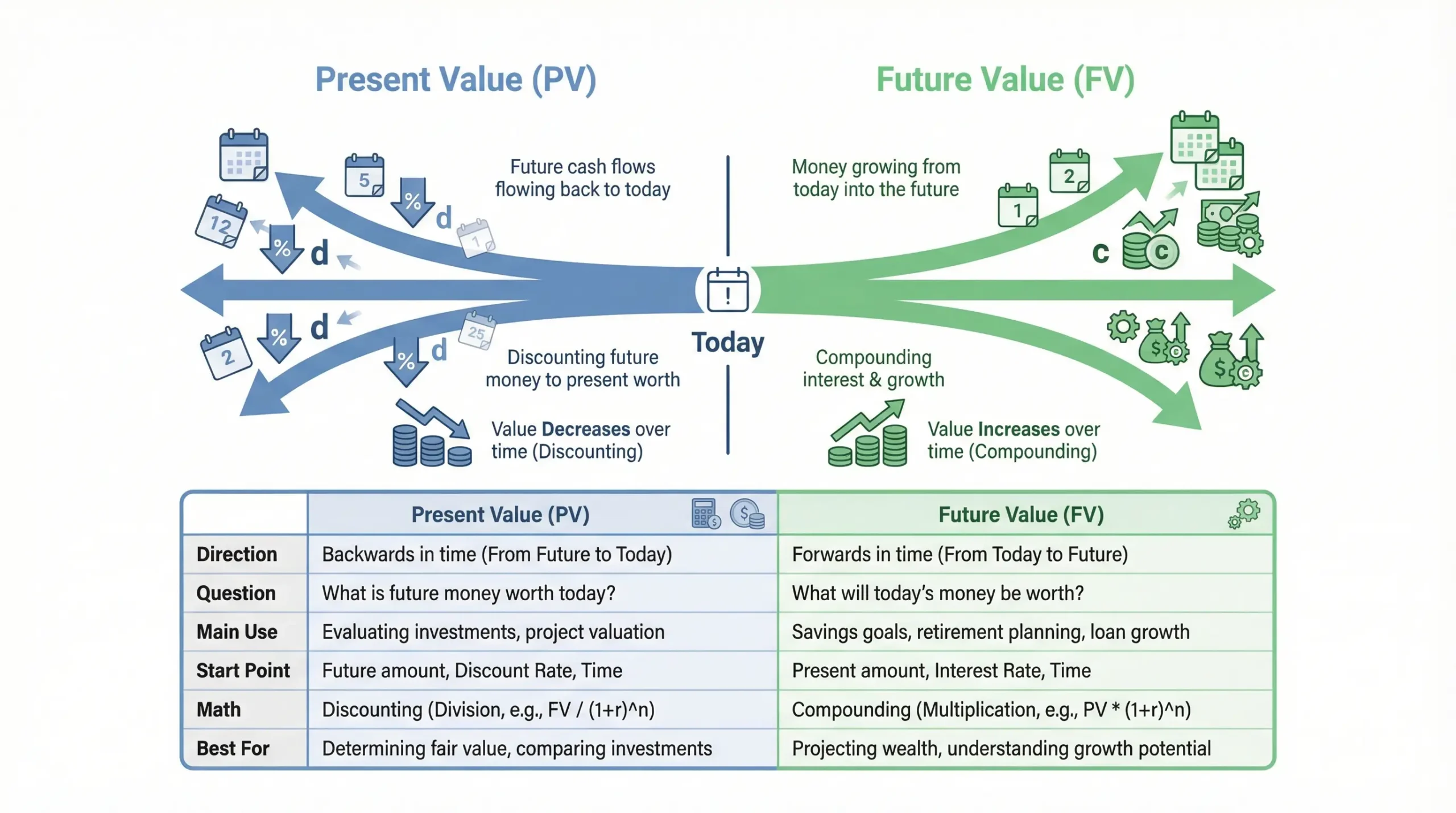

Direction of Time

The biggest difference is simple. Present value moves backward in time. Future value moves forward.

- When you use present value, you start with money you’ll get later. Then you ask: “What’s this worth today?” You’re bringing future money back to now.

- When you use future value, you start with money you have now. Then you ask: “What will this be worth later?” You’re pushing today’s money into the future.

Same math. Opposite directions.

The Comparison Table

Here’s a quick look at the key differences:

| Factor | Present Value (PV) | Future Value (FV) |

|---|---|---|

| Direction | Backward in time | Forward in time |

| Question It Answers | “What’s future money worth today?” | “What will my money grow to?” |

| Main Use | Evaluating offers, loans, bonds | Planning savings, retirement goals |

| What You Start With | Money you’ll get later | Money you have now |

| The Math | Discounting (dividing) | Compounding (multiplying) |

| Best For | Comparing investment options | Setting financial targets |

Here’s the simple rule I use: If someone is offering you money later, use present value to see if it’s a good deal. If you’re saving or investing money now, use future value to see where you’ll end up.

Both calculations use the same basic ideas. Interest rates. Time periods. Compounding. But they point in different directions.

And once you know which direction you need to go, the rest is just plugging in the numbers.

Real-World Examples: PV vs. FV in Action

Scenario A: The Lottery Decision (Lump Sum vs. Waiting)

The Offer: You win a contest. You can take $10,000 Today OR $15,000 in 5 Years. The Test: If you take the $10,000 now and invest it at 8% return, will it grow to more than $15,000?

1. Go to the Future Value Calculator Enter this exact data for “Option A”:

-

Number of Periods (N): 5 (Years to wait)

-

Starting Amount (PV): $10,000 (The cash you get now)

-

Interest Rate (I/Y): 8% (Rate you could earn)

-

Compounding: Annually (Simple comparison)

-

Periodic Deposit (PMT): $0 (No extra savings)

-

PMT made at the: End

3. Check the Result: You will see a Future Value of roughly $14,693.28.

The Verdict:

-

Option A (Invest Now): Grows to $14,693.

-

Option B (Wait 5 Years): Guaranteed $15,000.

-

Winner: Option B (Waiting) is the mathematically smarter choice here because $15,000 is greater than $14,693.

Scenario B: The Retirement Gap (Am I saving enough?)

The Problem: You are 30 years old. You want to retire at 65 (35 years later) with $1 Million. You currently save $500 a month and have nothing started yet.

1. Hit “Reset” on the Calculator. 2. Enter your plan:

-

Number of Periods (N): 35 (Years until retirement)

-

Starting Amount (PV): $0 (Starting from scratch)

-

Interest Rate (I/Y): 7% (Average market return)

-

Compounding: Monthly (Standard for savings)

-

Periodic Deposit (PMT): $500 (Your monthly contribution)

-

PMT made at the: End

3. Check the Result: You will see a total of roughly $828,000.

You are short by $172,000. The Fix: Don’t guess. Change the Periodic Deposit (PMT) to $650 and check again. You will see the number cross the $1,000,000 mark. Now you have a real plan.

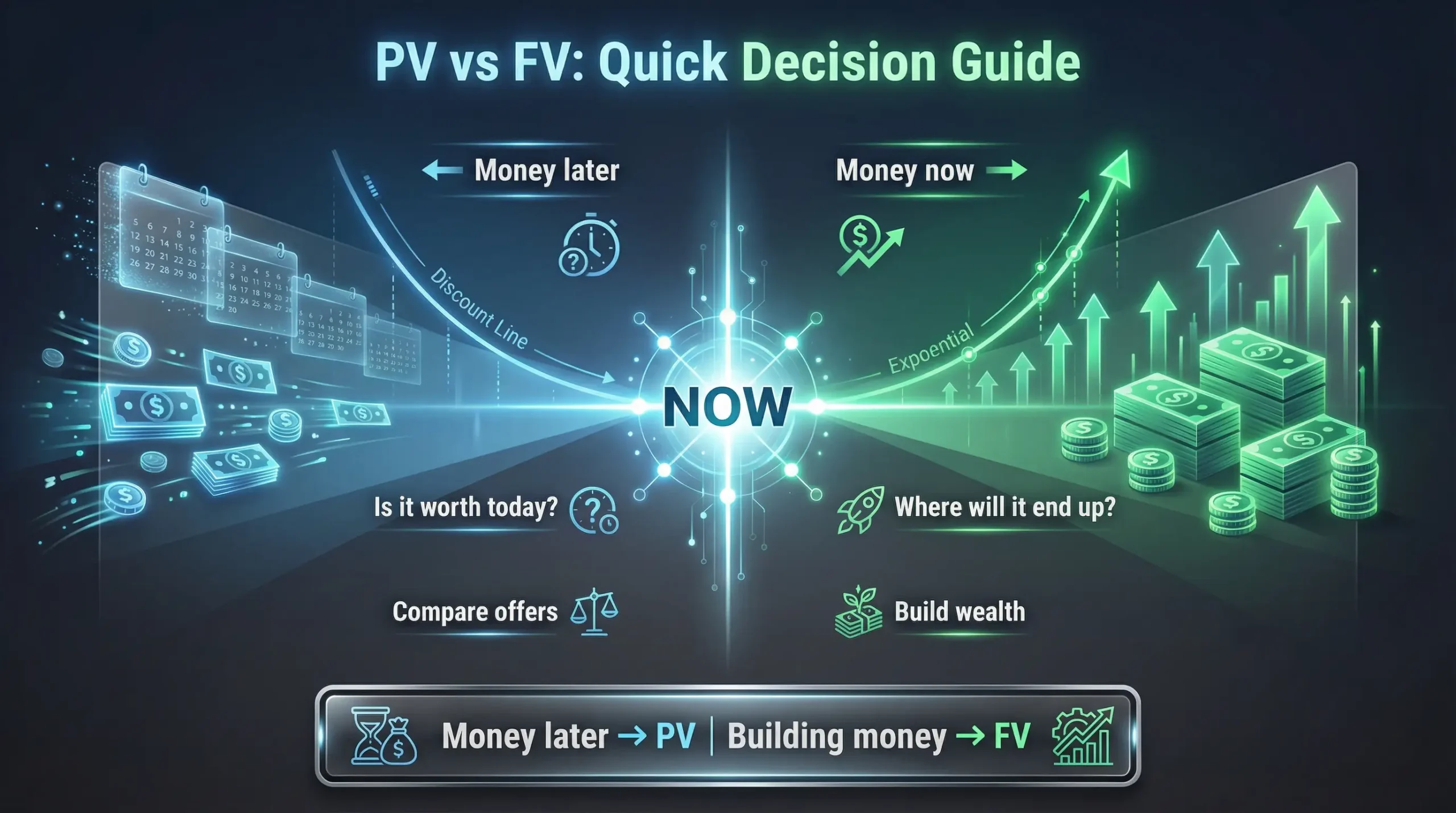

Quick Decision Guide: Which One Do You Need?

Let’s make this really simple. Here’s how to know which calculation you need for your situation.

Use Present Value If…

You should use present value when someone offers you money in the future and you need to decide if it’s worth it.

Use PV when:

- Someone offers you a lump sum now versus payments later (like a lottery payout or settlement)

- You’re comparing a job offer with a signing bonus today versus a bigger bonus in 3 years

- You’re buying a bond and want to know if the price is fair

- You need to value a business based on its future cash flows

- You’re deciding between taking your pension as monthly payments or one big check

- A company wants to buy you out of a contract and you need to know what it’s really worth

- You’re evaluating any investment that pays you back over time

The key question PV answers: “Is this future money worth more or less than what I can do with cash today?”

If you can invest money yourself at 8% and someone offers you $20,000 in 5 years, present value tells you that’s only worth about $13,612 today. You’d be better off taking $15,000 now and investing it yourself.

Use Future Value If…

You should use future value when you’re planning ahead and need to know if you’ll hit your money goals.

Use FV when:

- You’re planning for retirement and want to know if your savings will be enough

- You’re saving for a house and need to set a monthly savings target

- You want to compare two different investment options to see which grows more

- You need to plan for your kid’s college tuition in 15 years

- You’re checking if inflation will eat away too much of your savings

- You want to see what happens if you increase your monthly contributions

- You’re trying to figure out how long it will take to reach a specific dollar amount

The key question FV answers: “If I save this much money at this interest rate, where will I end up?”

If you’re 30 years old and save $500 a month at 7% interest, future value shows you’ll have about $566,000 by age 60. Now you know if that’s enough or if you need to save more.

Here’s my simple rule: If money is coming to you later, use PV. If you’re building money for later, use FV.

The Federal Reserve explains that inflation is a general increase in prices of goods and services over time, meaning a dollar will typically buy less in the future than it does today, a common reason why future cash is discounted when making financial decisions.

Final Thoughts

Financial freedom isn’t about guessing; it’s about knowing exactly what your money is doing. Whether you are evaluating a lump-sum offer today (Present Value) or building a nest egg for tomorrow (Future Value), the math gives you the clarity to choose correctly.

Don’t leave your financial future to chance or intuition. Use the Future Value Calculator to run your specific numbers, compare your options, and make the decision that maximizes your wealth.