You know that feeling when you want to save money, but somehow your bank account stays empty? I used to check my savings every week, hoping to see growth, but the number barely moved. The problem wasn’t my income – it was my approach. I was saving with my heart, not my head.

Most people try to save money the hard way. They rely on willpower and hope things work out. But here’s what I learned: data-driven savings beats wishful thinking every time. When you use numbers, tools, and simple systems, saving becomes automatic.

Think about it this way – you wouldn’t drive to a new place without GPS, right? So why try to build wealth without a clear map? The financial discipline that rich people have isn’t magic. It’s just good systems that do the work for you.

In this guide, I’ll show you ways to build financial discipline while setting savings goals that actually stick. You’ll learn simple tricks that make saving feel easy, not painful. By the end, you’ll have a clear plan that works even when life gets busy.

Ready to finally see your savings grow? Let’s start with the basics that changed everything for me.

Ways to Build Financial Discipline Using Data-Driven Savings Goals

Here’s the truth most people don’t want to hear: hoping to save money doesn’t work. I learned this the hard way when I spent three years “trying” to save for a car. My method? Put aside whatever was left at the end of the month. Guess what was usually left? Nothing.

Traditional savings

Traditional savings methods rely on feelings and guesswork. People say things like “I’ll save $500 this month” without checking if they actually have $500 to spare. It’s like trying to bake a cake without measuring ingredients – you might get lucky, but probably not.

Data-driven savings

Data-driven savings flips this around. Instead of guessing, you use real numbers from your spending habits. You track what comes in, what goes out, and what’s actually possible to save. This approach works because it’s based on facts, not wishes.

When you use data, you can see patterns you never noticed before. Maybe you spend $200 on coffee each month, or your grocery bill jumps every Friday. These insights help you make smart choices about where to cut back and how much you can really save.

A simple way to improve spending discipline is to use a Discount Calculator when shopping, so you always know the true price before buying.

The best part? Data doesn’t lie or let you down. Numbers show you exactly what’s working and what isn’t.

Setting SMART Financial Goals

Most people set goals that sound good but fall apart fast. “I want to save more money” feels nice to say, but it’s useless as a real plan. SMART goals change everything because they force you to get specific about what you actually want.

The Complete SMART Framework for Savings Success

SMART stands for five simple rules that make goals work. First is Specific – instead of “save money,” try “save $2000 for a vacation.” Second is Measurable – you need to track your progress in real numbers, not feelings.

Third is Achievable – your goal must be possible with your current income. If you make $3000 a month, saving $2500 won’t work. Fourth is Realistic – consider your real-life situation. Do you have kids? Student loans? Be honest about what you can actually do.

Last is Time-bound – set a clear deadline. “Save $2000 by December 31st” beats “save $2000 someday” every time.

Examples of Effective vs. Ineffective Goal Setting

Bad goal: “I want to build wealth.” This tells you nothing about what to do or when to do it.

Good goal: “I will save $200 every month for 12 months to build a $2400 emergency fund by next Christmas.”

See the difference? The good goal gives you exact steps, amounts, and deadlines. You know exactly what success looks like, and you can measure your progress each month.

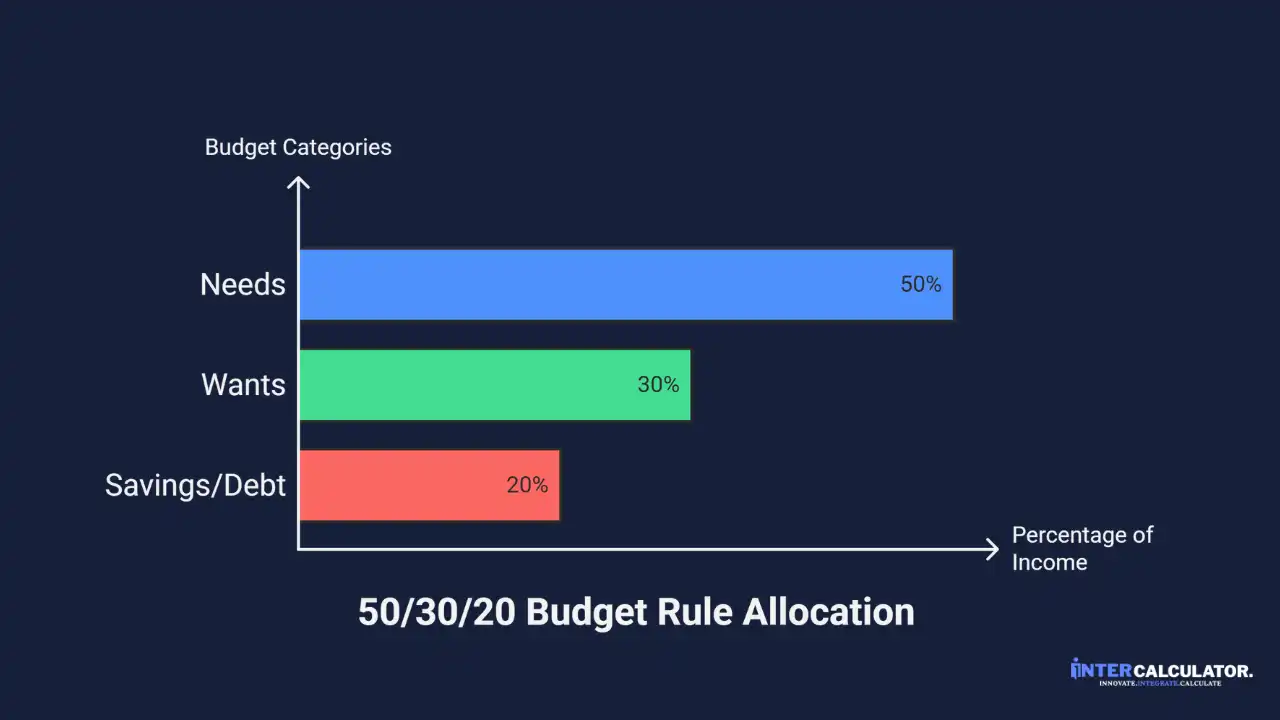

The 50/30/20 Budget Rule for Automated Discipline

The 50/30/20 rule is the simplest way to split your money without thinking too hard about it. I wish someone had taught me this when I first started working – it would have saved me years of financial stress.

Here’s how it works: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt. It’s like having training wheels for your money. You don’t need to be perfect with budgets or track every penny.

How to Calculate Your Optimal Allocation

Let’s say you earn $4000 per month after taxes.

Your budget is as follows:

- Needs: $2000 for rent, groceries, and utilities.

- Wants: $1200 for movies, clothes, and eating out.

- Savings/Debt: $800 for savings or paying off debt.

Start by listing your actual needs – not wants disguised as needs. Housing, food, transport, and basic bills count. Everything else is a want, even if it feels important.

Adjusting the Rule for Different Income Levels

If you’re just starting out or have a low income, try 60/30/10 instead. When you get raises, slowly move toward the full 20% savings rate. High earners might do 50/20/30, putting extra money toward financial goals.

To estimate how your savings will grow in the future, you can use a Future Value Calculator to see exactly how compound interest affects your long-term goals.

The key is picking numbers that work for your real life, then sticking to them no matter what.

Automation Strategies That Build Savings Without Willpower

Let me tell you about the day that changed my financial discipline forever. I was sitting in a coffee shop, frustrated because I’d spent my “savings money” on random stuff again. That’s when my friend Maria showed me her phone – she had $8000 saved up, and she said she never even thought about it anymore.

Her secret? Automation. She set up her money to save it before she could mess it up. No willpower needed, no daily decisions, no guilt when she wanted to buy something fun.

Setting Up Your “Pay Yourself First” System

Pay yourself first means your savings get taken care of before you can spend it on anything else. Set up an automatic transfer from your checking account to savings the day after you get paid. Even $50 per paycheck adds up fast.

Most banks let you do this online in about five minutes. Pick an amount that feels easy – you can always increase it later. The goal is to build the habit first, then grow the amount.

Advanced Automation: Multiple Goal Buckets

Once basic savings become automatic, try the bucketing system. Set up separate savings accounts for different goals. One for emergencies, one for vacation, one for a car down payment.

Each bucket gets its own automated transfer. Maybe $100 goes to the emergency fund, $75 to vacation, and $50 to the car fund every month. This way, you’re making progress on multiple financial goals at once without thinking about it.

Now I have gathered sufficient accurate data from credible sources. Let me write the section using only verified information with proper citations and working links.

Overcoming Common Savings Obstacles

Saving money isn’t always smooth sailing. Even with the best plans, life throws curveballs that can mess up your financial discipline. But knowing what to expect helps you stay on track when things get tough.

Dealing with Unexpected Expenses

Unexpected expenses hit most of us harder than we think. The Federal Reserve’s 2024 Survey of Household Economics and Decisionmaking found that 37% of Americans would struggle to pay a $400 emergency expense with cash or savings.

The research from Empower shows that in 2024, the median emergency savings for Americans is just $600, while 21% have no emergency savings at all

Here’s what works: start small with automated transfers, even if it’s just $25 per month. Build your emergency fund slowly while keeping your main savings goals on track.

Staying Motivated During Slow Progress Periods

Research from the University of Southern Denmark shows that your motivation for saving affects how well you handle challenges. According to Professor Nikos Ntoumanis, self-driven motivation leads to better progress than pressured motivation.

Studies in behavioral psychology reveal that breaking big goals into smaller chunks helps maintain motivation through goal gradient theory – the closer you get to finishing something, the more motivated you become.

Short-Term vs. Long-Term Savings Goals (with timelines)

Understanding the difference between short-term and long-term savings goals helps you plan better. Short-term goals keep you motivated with quick wins, while long-term goals build real wealth over time.

- Short-term goals are things you want within 1-2 years. These might include an emergency fund, vacation, or new laptop. Since you need the money soon, keep it in a high-yield savings account where it’s safe and easy to access.

- Long-term goals take 5+ years to reach. Think retirement, house down payment, or kids’ college fund. For these goals, you can take more risk with investments since you have time to recover from market ups and downs.

If you’re planning to invest for long-term growth, a Dividend Calculator helps you estimate how much passive income your investments can generate over time.

- Medium-term goals fall somewhere in between – maybe 2-5 years. A new car or wedding falls here. You might use a mix of savings and conservative investments.

Here’s how different financial goals break down by timeline:

| Goal Type | Timeline | Examples | Best Account Type |

| Short-Term | 1-2 years | Emergency fund, vacation, new phone | High-yield savings account |

| Medium-Term | 2-5 years | Car down payment, wedding, home repairs | Savings + CDs or conservative investments |

| Long-Term | 5+ years | House down payment, retirement, kids’ college | Investment accounts, 401 (k), IRA |

The key is matching your savings strategy to your timeline. Don’t put money you need next year in the stock market, and don’t keep retirement money in regular savings where it won’t grow.

Recommended Tools: apps, spreadsheets, trackers

The right tools make tracking your progress simple and automatic. You don’t need fancy software – even a basic spreadsheet works better than keeping everything in your head.

![]()

Best Apps for Savings Goals

Mint connects to your bank accounts and tracks spending automatically. It shows exactly where your money goes each month, which helps you find extra cash to save. The app is free and works on phones and computers.

- YNAB (You Need A Budget) uses the zero-based budget system, where every dollar gets a job. It costs about $14 per month, but many people say it saves them way more than that.

- Simplifi and Monarch Money are newer apps that combine budgeting with goal tracking. They show your progress toward multiple savings goals in one place.

Physical Progress Trackers

Don’t underestimate the power of seeing your progress on paper. Visual trackers work because your brain loves checking things off lists.

You can buy printable savings trackers online or make your own. Some people use a simple chart on their fridge. Others prefer apps that show progress bars filling up as you save.

The best tool is the one you’ll actually use. Try a few different options and stick with whatever feels natural for your daily routine.

Simple Spreadsheet Templates

Sometimes old-school works best. A basic spreadsheet lets you customize everything exactly how you want it. Create columns for your goal amount, current savings, monthly target, and progress percentage.

Google Sheets or Excel both work fine. The important thing is updating it regularly – maybe every payday or once a week.

You can view or download a sample sheet that I have made. This includes all the formulas and formatting you need to start tracking your savings goals right away.

How to Set It Up:

- Put your goal name in column A. Column B is your target amount. Column C tracks how much you’ve saved so far – update this weekly or monthly.

- Column D shows how much you need to save each month. Column E is your deadline. Column F calculates your progress percentage (Current ÷ Target × 100).

- Column G shows months remaining until your deadline. This helps you see if you’re on track or need to save more each month.

Pro Tips:

Use different colors for goals you’re ahead on (green) versus behind (red). Add a row at the bottom that totals your monthly savings targets – this shows exactly how much you need to set aside each month for all goals.

Update it every time you make a deposit. Seeing those percentages climb keeps you motivated to stick with your financial discipline.

Final Thoughts

Building financial discipline doesn’t have to be complicated or painful. The key is using data-driven savings instead of hoping for the best. Set SMART goals, automate your transfers, and track your progress. Saving will feel as natural as paying your phone bill.

I’ve seen people transform their money habits in just a few months using these simple systems. Start with one thing – maybe the 50/30/20 rule or setting up a single automatic transfer. Once that feels easy, add another piece.

Remember, every wealthy person you know uses these same basic principles. They just make their money work smarter, not harder. Your future self will thank you for starting today, even if it’s just $25 this month.

The hardest part is always the first step. But now you have the tools to make savings goals that actually stick. Stop hoping your bank account will grow – make it happen with systems that work while you sleep.

Ready to take control? Pick one strategy from this guide and set it up this week. Your financial freedom is waiting.

FAQs

How does saving contribute to financial discipline?

Saving builds financial discipline by creating automatic good habits. When you save regularly, you train your brain to think before spending. Plus, having savings reduces money stress, so you make better choices.

What are the 5 steps to achieve your savings goal?

- Set a SMART goal with a specific amount and a clear deadline

- Calculate exactly how much you need to save each month

- Set up automatic transfers from checking to savings

- Track your progress monthly using apps or spreadsheets

- Adjust your plan if your income or expenses change

How can a savings account help you achieve financial goals?

A savings account keeps your money separate from spending money. High-yield savings accounts earn interest while you save. You can also use multiple accounts for different goals, like vacation or emergencies.

What is the 7 rule for savings?

The 7-day rule means waiting 7 days before big purchases. Often, you’ll realize you don’t need the item. Some people also save 7% of their income if 20% feels too hard.

Why is it important to set a savings goal?

Savings goals give your brain a clear target to work toward. Without goals, saving feels pointless. Goals also help you calculate exactly how much to save each month, making big amounts feel manageable.