You know how people buy insurance for their car? They pay a small amount now to protect themselves from big losses later. Well, derivatives work in a similar way in the world of money and investing.

Here’s the thing most people don’t tell you: derivatives aren’t just for Wall Street experts in fancy suits. Farmers use them to lock in prices for their crops. Airlines use them to protect against rising fuel costs. Even some regular investors use them to protect their savings.

In this guide, I’ll walk you through everything about what these financial contracts are, how they work, and whether they might make sense for you. By the end, you’ll actually understand what financial news reporters are talking about when they mention options, futures, or swaps.

Let’s get started.

What are derivatives in finance?

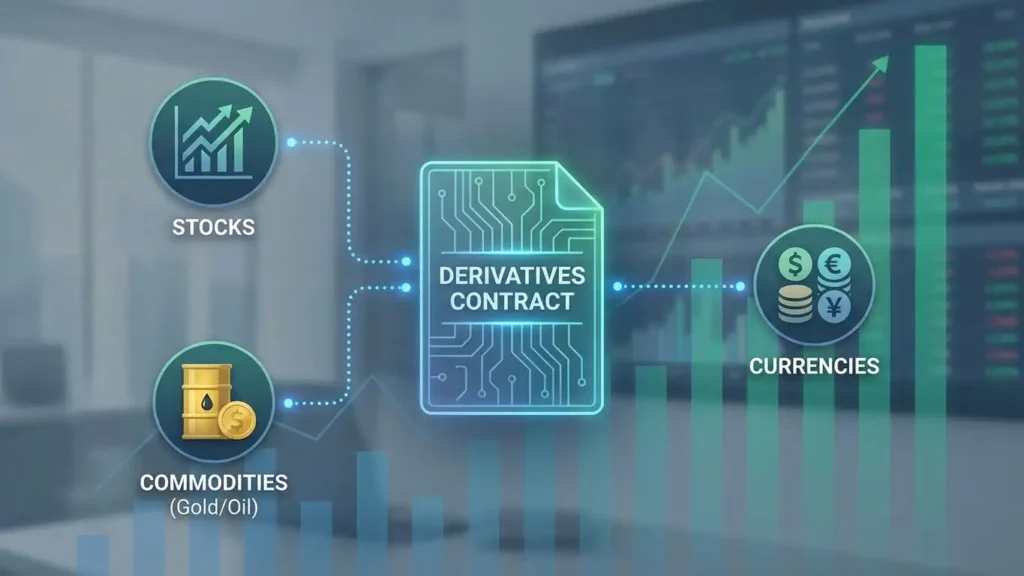

A derivative is a financial contract whose value depends on an underlying asset, like a stock, commodity, bond, or currency. For example, instead of buying Apple stock today, you could buy a derivative that gives you the right to buy it later at today’s price.

If the stock price rises, you profit; if it falls, you may not exercise the contract. Monitor stock trends and averages using our Stock Average Calculator to guide your decisions. The term “derivative” comes from the fact that its value is derived from something else, the underlying asset.

How Do Derivatives Work?

Here’s the part that confused me for months: how does a piece of paper become worth money? The secret is that derivatives track something real. When that real thing moves, your contract moves with it.

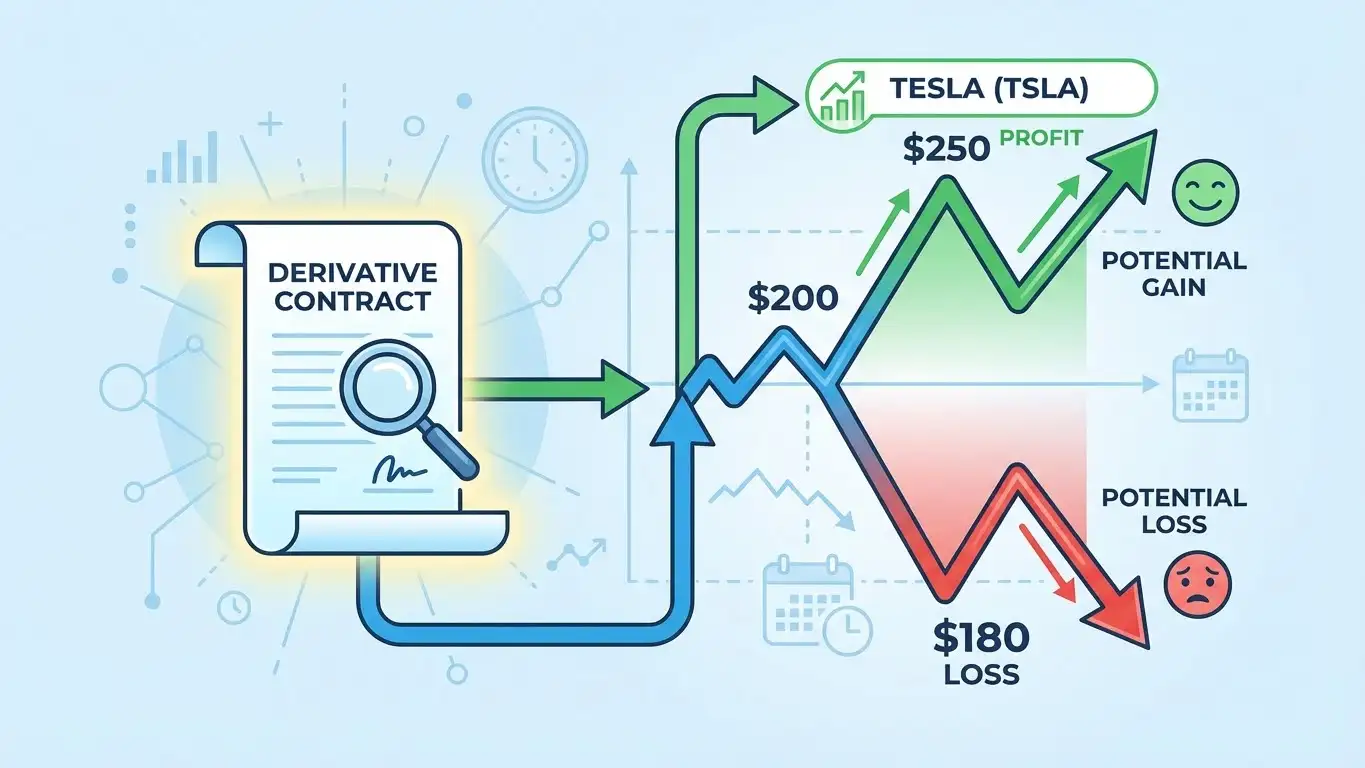

Let’s say Tesla stock is trading at $200 today. You buy a derivative that locks in a buying price of $210. If Tesla jumps to $250, your contract is suddenly worth real money because you can buy at $210 and sell at $250. That’s a $40 profit per share. But if Tesla drops to $180, your contract becomes worthless because why would you buy at $210 when the market price is cheaper?

The whole system works on timing and prediction. You’re basically making a bet on where the price will be in the future. Get it right, you win. Get it wrong, you lose. Derivatives let you leverage positions, but understanding compounding is key. You can know more in our Compound Interest guide.

The Basic Mechanics of Derivatives

Creating a derivative contract starts simple. Two parties agree on terms: what asset they’re dealing with, what price they’ll use, and when the deal closes. This happens on an exchange or privately through custom deals.

Once the contract exists, it becomes its own thing. You can hold it until the end date or sell it to someone else. That’s what makes derivatives so flexible, like concert tickets you can resell.

The value changes every day based on the underlying asset. If you’ve got a contract to buy gold at $1,800 and gold jumps to $2,000, your contract just became very valuable.

The profit or loss is simple: what’s the difference between your contract price and the actual market price? If your contract lets you buy cheaper than the market, you win. If it forces you to buy higher, you lose.

Real-World Example: Stock Option in Action

Let me walk you through a real scenario. Tesla stock was trading at $180 per share. I thought it might jump after their earnings report, so I looked at buying a call option.

I found an option contract that gave me the right to buy 100 shares of Tesla at $190 per share. The option expired in one month. To buy this contract, I paid a premium of $5 per share, $500 total upfront.

Three weeks later, Tesla announced better sales. The stock shot up to $220 per share. My contract became valuable because I could buy 100 shares at $190 and sell them at $220. That’s a $30 profit per share, minus my $5 cost, so $25 profit per share. On 100 shares, that’s $2,500 profit from a $500 investment.

But if Tesla dropped to $170, my option would expire worthless. I wouldn’t use it because why buy at $190 when the market price is $170? I’d lose my entire $500 premium.

The beautiful part? My maximum loss was capped at $500. If I’d bought the actual stock, I could’ve lost much more if Tesla crashed. You can calculate potential losses for your investments using our Maximum Drawdown Calculator. That’s why people use derivatives, they control big positions with small money and can limit their downside.

What are the 4 types of derivatives?

These are the main 4 types of derivatives:

- Options

- Futures Contracts

- Forwards

- Swaps

When I started learning about derivatives, I thought there were hundreds of different kinds. Turns out, there are really just four main types. Everything else is just a variation of these.

The four big ones are options, futures, forwards, and swaps. Each one works differently, and each one is used for different situations. Let me break them down for you.

Let’s talk about the 4 types of derivatives

Options

An option gives you the right to buy or sell something, but you don’t have to if you don’t want to. That’s the keyword, right, not obligation. You paid for the choice, and now you can use it or ignore it.

There are two types. A call option lets you buy an asset at a set price. A put option lets you sell an asset at a set price. The set price is called the strike price, and you have until the expiration date to decide.

Futures Contracts

A futures contract is different because you must follow through. No choice here. You agreed to buy or sell something at a certain price on a certain date, and you’re locked in.

These are standardized and traded on big exchanges like the Chicago Board of Trade. Everything is the same for everyone, same amounts, same quality, same rules. That makes them easy to buy and sell.

Futures are huge in commodities. Think oil, wheat, gold, and natural gas. According to the U.S. Commodity Futures Trading Commission, these contracts help farmers and producers manage price risk effectively. A farmer might sell wheat futures in March for delivery in September. He locks in $7 per bushel today, even though he hasn’t harvested yet. If wheat drops to $5 by September, he still gets $7. If it jumps to $9, he’s stuck selling at $7. That’s the trade-off.

Airlines do this with crude oil to lock in fuel costs. If oil prices explode, they’re protected. They gave up the chance at cheaper oil to avoid the risk of expensive oil.

Forwards

A forward contract is basically a futures contract without the exchange. It’s a private deal between two parties, usually negotiated over-the-counter or OTC.

The big difference? You can customize everything. The amount, the quality, the date, the terms—it’s all flexible. But there’s a catch: these are way less liquid. You can’t easily sell a forward to someone else because it was made just for you.

I’ve seen businesses use currency forwards all the time. Say a U.S. company owes 1 million euros to a German supplier in six months. They don’t know if the dollar will get weaker or stronger. So they buy a forward contract to lock in today’s exchange rate. Now they know exactly how many dollars they’ll need. No surprises.

The downside? If the dollar gets stronger and euros get cheaper, they’re stuck paying the higher locked-in rate. But for many companies, that predictability is worth it.

Swaps

Swaps are the weird ones. Instead of buying or selling an asset, you’re swapping cash flows with someone else. It’s like trading payment streams.

The most common type is an interest rate swap. Here’s how it works: Company A has a loan with a floating interest rate that changes every year. Company B has a loan with a fixed rate. They agree to swap payments. Company A pays Company B’s fixed rate, and Company B pays Company A’s floating rate.

Why would anyone do this? Maybe Company A wants stability and doesn’t want to risk rates going up. Company B thinks rates will drop and wants to benefit from that. Both get what they want.

Banks and big corporations use swaps constantly. Data from the Bank for International Settlements’ derivatives statistics show that interest rate swaps represent the majority of all derivative trading worldwide. I once read about a company that had $500 million in debt at a floating rate. They were terrified rates would spike, so they entered a swap to convert it to a fixed rate. Cost them some money upfront, but they slept better at night.

Other types include currency swaps, commodity swaps, and even credit default swaps (which played a big role in the 2008 financial crisis, but that’s another story).

Exotic vs. Vanilla Derivatives

When traders talk about vanilla derivatives, they mean the simple, straightforward ones. These are your basic call options, put options, and standard futures contracts. They’re called “plain vanilla” because there’s nothing fancy about them, just like vanilla ice cream is the basic flavor.

Vanilla

Vanilla products are standardized and easy to understand. You buy them on exchanges, the prices are clear, and millions of people trade them every day. If you’re starting out, stick with these. They’re predictable, and you won’t get surprised by weird rules.

Exotic Derivatives

Now exotic derivatives are a whole different game. These have special features and complex rules built in. For example, a barrier option only becomes active if the stock price hits a certain level. An Asian option uses the average price over time instead of the price on one day. I’ve even heard of options that pay out based on the performance of two different stocks at once.

Usually, big institutions and hedge funds that need very specific protection or want to make very specific bets. A company doing business in three countries might use an exotic currency derivative that tracks all three currencies. You won’t find these on regular exchanges; they’re custom-made over-the-counter deals that cost more but do exactly what the buyer needs.

| Feature | Vanilla Derivatives | Exotic Derivatives |

|---|---|---|

| Complexity | Simple, easy to understand | Complex with special features |

| Trading | On regulated exchanges | Custom OTC deals |

| Standardization | Fully standardized | Highly customizable |

| Cost | Lower fees and premiums | Higher costs |

| Users | Individual investors, small businesses | Large corporations, hedge funds, banks |

| Examples | Basic call options, standard futures | Barrier options, Asian options, multi-currency deals |

| Liquidity | Very liquid, easy to sell | Less liquid, harder to exit |

Advantages and Disadvantages of Derivatives

I’ll be honest, when I first considered using derivatives, I was both excited and nervous. They sounded powerful but risky. And you know what? They’re both.

The truth is, derivatives can help you or hurt you depending on how you use them. It’s like having a chainsaw, an amazing tool in the right hands, dangerous if you don’t know what you’re doing. Let me show you both sides so you can decide for yourself.

Key Benefits of Trading Derivatives

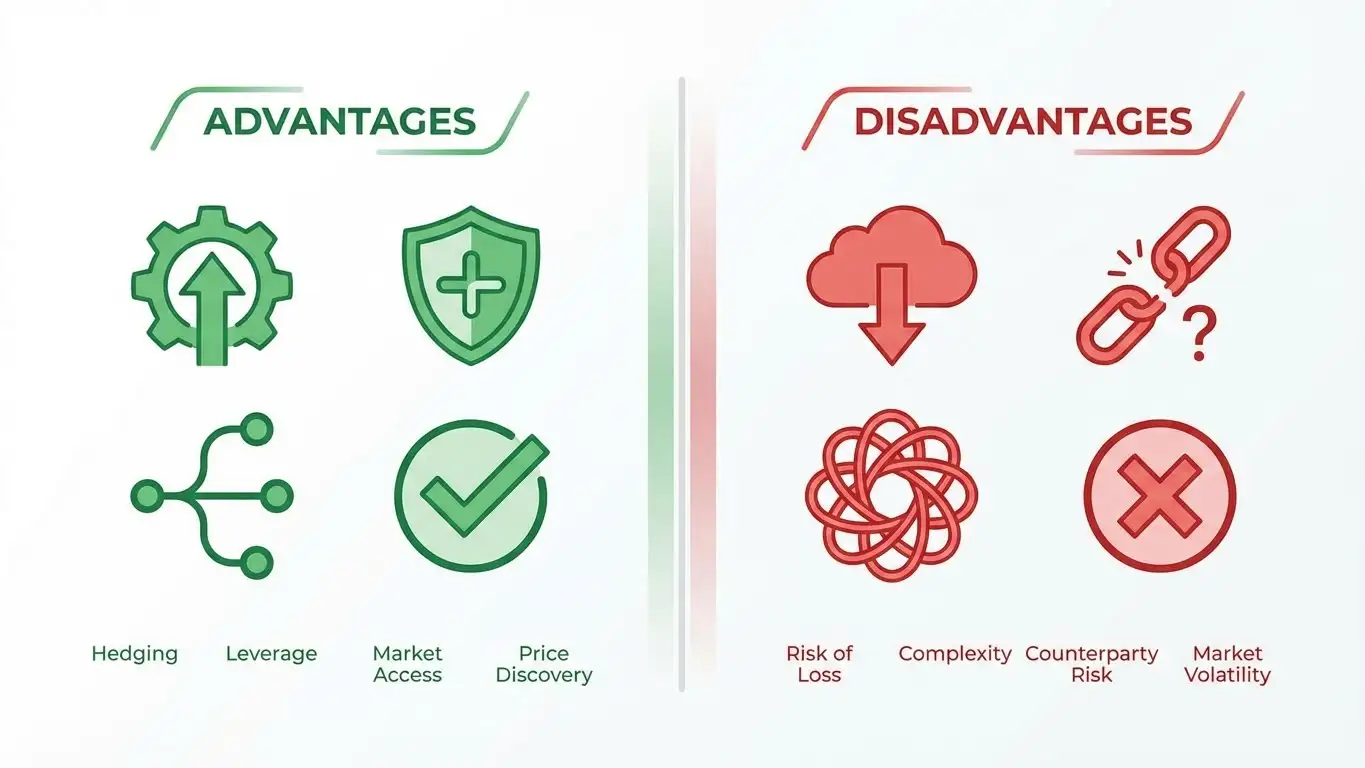

Derivatives offer some real advantages that regular stock and bond investing can’t match. Here’s what makes them attractive:

- Leverage: You can control a big position with very little money up front. A $500 option might give you control over $50,000 worth of stock. That means little money can lead to big gains if you’re right.

- Flexibility: There are so many strategies you can use. Want to protect your portfolio? Buy a put option. Think prices will stay flat? Sell a covered call. The possibilities are huge.

- Risk Management: This is the real power. Derivatives let you hedge against losses. Farmers lock in crop prices. Airlines lock in fuel costs. You can lock in stock prices to protect your savings.

- Market Access: You can get exposure to things you couldn’t normally buy. Want to bet on oil prices without buying barrels of oil? Futures let you do that. Want exposure to the S&P 500 without buying 500 different stocks? Index options make it easy.

- Cost Efficiency: Sometimes buying a derivative is cheaper than buying the actual asset. Plus, you can make money whether prices go up or down; you’re not stuck waiting for things to rise.

Risks and Drawbacks to Consider

Now here’s where it gets serious. Derivatives come with real risks that can hurt you badly if you’re not careful:

- Complexity: These things are confusing. I’ve seen people lose money simply because they didn’t understand what they bought. The terms, the rules, the math—it takes time to learn, and mistakes are expensive.

- Leverage Risk: Remember how leverage lets you control big positions with small money? Well, it works both ways. You can lose more than you invested. I knew someone who lost $10,000 on a $2,000 futures trade because the market moved against him fast.

- Counterparty Risk: In over-the-counter deals, you’re trusting the other party to pay up. If they go bankrupt, you might get nothing. This isn’t a problem on exchanges where the clearinghouse guarantees trades, but it’s real in private deals.

- Market Risk: Derivatives can be extremely volatile. Prices swing wildly based on news, rumors, and market sentiment. What’s worth $1,000 today might be worth $100 tomorrow.

- Time Decay: With options, time is your enemy. Every day that passes, your option loses value even if the stock doesn’t move. It’s called time value, and it drains away as you get closer to the expiration date.

- Costs Add Up: You pay premiums to buy options. You pay margin requirements for futures. You pay commissions to brokers. These fees can eat into your profits, especially if you trade frequently.

Should You Invest in Derivatives?

This is the question I get asked most. And honestly? For most people, the answer is no, at least not right away. If derivatives feel too risky, start with structured savings. You can get help from our Savings Goals guide.

I’m not trying to scare you off. But derivatives are like power tools. They can do amazing things in skilled hands, but beginners often hurt themselves. You need to know what you’re doing before you jump in.

Who Should Consider Derivatives?

Derivatives aren’t for everyone. You need to meet certain requirements before diving in. Here’s who’s actually ready for this kind of investing:

- Experienced investors who understand stocks, bonds, and market basics

- High risk tolerance people who can afford to lose money

- Business owners needing to lock in commodity prices or protect portfolios

- Committed learners willing to study strike prices, margin requirements, and volatility

Alternatives for Beginners

If you’re not ready for derivatives, don’t worry. There are simpler ways to invest:

- Diversified ETFs – Exposure to hundreds of companies at once

- Mutual funds – Professionally managed, good for busy people

- Index funds – Track the whole market, recommended by Warren Buffett, who famously calls derivatives “financial weapons of mass destruction” when used recklessly, but advocates index funds for regular investors

- Financial advisors – Get personalized advice for your situation

The bottom line? Don’t rush into derivatives because they sound exciting. Build a solid foundation first with regular stocks and bonds. Learn how markets work. Get comfortable with volatility. Building confidence in your finances is crucial before trying complex tools like derivatives. You can read our Personal Finance Guide. Then, if you still want to explore derivatives, you’ll be ready.

Final Thoughts

So there you have it, derivatives explained without the confusing jargon.

Look, I get it. Derivatives sound exciting and profitable. But here’s my honest advice: if you’re new to investing, start simple. Get good at stocks and bonds first. Watch how the market moves. Learn from small wins and losses.

Once you’ve got experience and can afford to take risks, then maybe explore derivatives. Plan your expected returns ahead using our Future Value Calculator. They’re powerful tools, but only if you know what you’re doing.

Remember, the goal isn’t to use fancy financial instruments. The goal is to grow your money safely over time. Sometimes the boring way is the smart way.

What’s your take? Are you thinking about trying derivatives or sticking with traditional investing? Either way, make sure you understand what you’re getting into before you put real money on the line.

Stay smart out there.

FAQs About Derivatives

What is the difference between a stock and a derivative?

A stock is actual ownership in a company. A derivative is just a contract based on something else’s price—you don’t own the underlying asset, just a deal about it.

Are derivatives a good investment?

For experienced investors, yes. For beginners, no. Derivatives are risky and complex. Most people do better with simple ETFs or index funds that don’t require constant monitoring.

What is the 7% rule in stock trading?

The 7% rule says sell a stock if it drops 7% below your purchase price. It’s a risk management strategy to limit losses, though it doesn’t apply directly to derivatives, which work differently.

How do you make money off derivatives?

You profit when you correctly predict price movements. Buy a call option if you think prices will rise, or a put option if you think they’ll fall. The contract value increases as you predicted.

Does Warren Buffett invest in derivatives?

Yes, but carefully. Buffett uses derivatives for hedging and specific strategies, not speculation. He’s called them “financial weapons of mass destruction” when misused, so even he’s cautious with them.