Money can work for you while you sleep. Sounds amazing, right? That’s exactly what compound interest does. It’s like earning interest on your interest, a simple trick that can help you grow your savings faster or, if you’re not careful, make your debts grow bigger. Let me show you how it works.

What Is Compound Interest?

Compound interest is the process of earning interest on both your initial investment (the principal) and the interest that accumulates over time. Unlike simple interest, which grows only on your original deposit, compound interest grows faster as your balance increases.

Think of it like a snowball rolling down a hill; it gathers more snow and grows larger the longer it rolls. Your money works the same way when it’s earning compound interest.

People often credit Albert Einstein with calling compound interest “the eighth wonder of the world,” though there’s no solid record he actually said it. Still, it’s hard to argue with the sentiment; compound interest truly is a powerful wealth-building force.

How Does Compound Interest Work?

Here’s the magic: compound interest means your money earns interest, and then that interest earns more interest. It keeps building on itself, like a chain reaction.

Let me break it down with a simple example. Say you put $1,000 into a savings account with a 5% interest rate that compounds once a year.

- Year 1: You earn $50 in interest (5% of $1,000). Your new balance is $1,050.

- Year 2: Now you earn interest on $1,050, not just your original $1,000. So you get $52.50 this time. Your balance grows to $1,102.50.

- Year 3: You earn $55.13, and your total becomes $1,157.63.

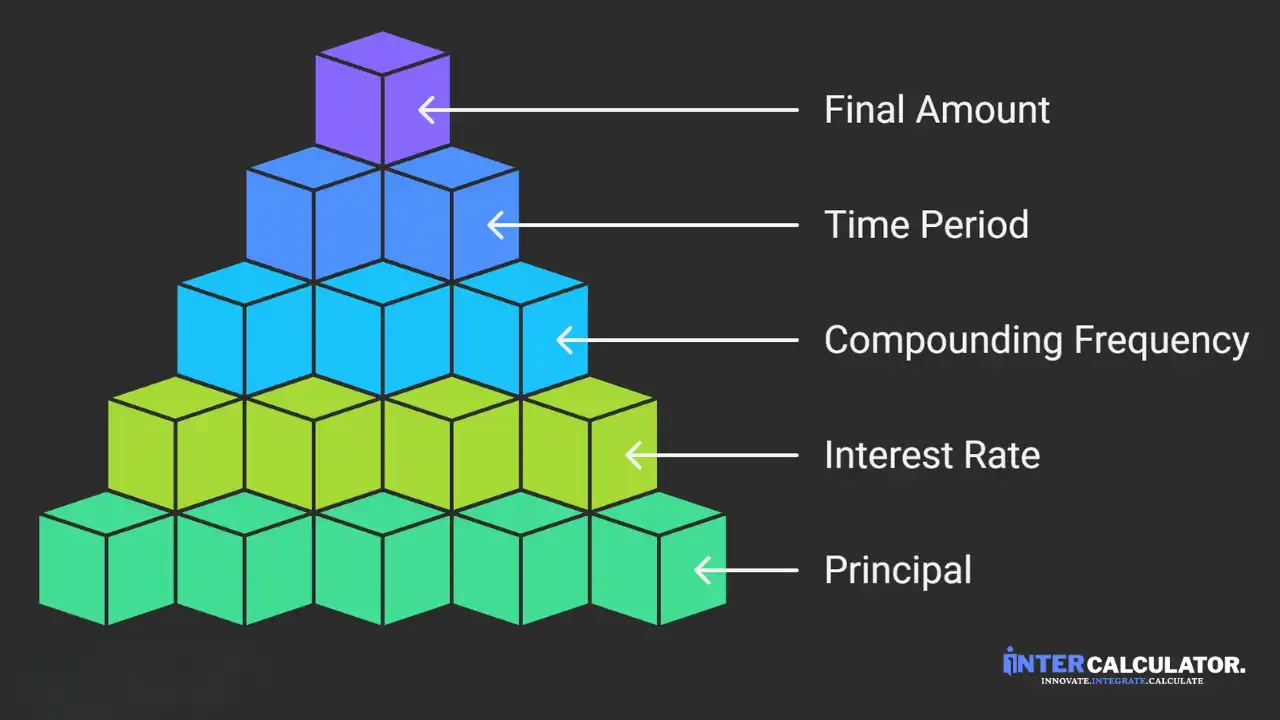

See what happened? Each year, your interest earned more because it was calculated on a bigger amount. According to the U.S. Securities and Exchange Commission, this process depends on four key things: your principal (starting amount), interest rate, time period, and compounding frequency (how often interest is added, daily, monthly, or yearly).

The more often it compounds, the faster your money grows.

Compound Interest vs. Simple Interest

Let me show you the big difference between these two.

- Simple interest only earns on your starting amount. If you put in $1,000 at 5%, you get $50 every year, always the same.

- Compound interest earns on your starting amount PLUS all the interest you’ve already earned. So your earnings grow bigger each year.

Here’s a quick look:

| Feature | Simple Interest | Compound Interest |

| Earns on | Original amount only | Original + past interest |

| Growth speed | Stays flat | Gets faster over time |

| Common in | Some personal loans | Savings accounts, credit cards |

| Better for | Borrowers | Savers |

The Compound Interest Formula

Okay, I’ll be honest, formulas can look scary at first. But this one is actually pretty simple once you break it down.

Here’s the compound interest formula:

A = P(1 + r/n)^(nt)

Let me explain what each letter means:

- A = The final amount you’ll have

- P = Your principal (the money you start with)

- r = Annual interest rate (as a decimal, so 5% = 0.05)

- n = How many times interest compounds per year

- t = Number of years

You can easily apply this formula with our Free Future Value Calculator to see how much your money will grow over time.

Quick example: You invest $1,000 at 5% interest, compounded monthly for 3 years.

A = 1,000(1 + 0.05/12)^(12×3)

A = 1,000(1.004167)^36

A = $1,161.47

You made $161.47 just by letting your money sit there!

Advanced note: In some cases, interest compounds continuously, meaning it’s added an infinite number of times per year. Mathematically, this is represented as A = Pe^(rt), where “e” is a constant (~2.718). You’ll see this concept used in advanced finance and scientific models.

Factors That Affect Compound Interest

Not all compound interest is created equal. Some accounts grow your money faster than others. Here’s what makes the difference:

- Interest Rate

This one’s obvious: the higher the rate, the faster your money grows. A 6% rate will double your money much quicker than a 3% rate. Even a 1% difference can mean thousands of dollars over time. - Compounding Frequency

How often does interest get added? Daily compounding beats monthly, which beats yearly. According to the Consumer Financial Protection Bureau, increasing your compounding frequency helps your savings grow faster because you’re earning interest on interest more often. - Time Period

Time is your best friend here. The longer you leave your money untouched, the more powerful compounding becomes. That’s why starting early, even with a small amount, beats starting late with more money. - Additional Contributions

Adding money regularly supercharges your growth. If you drop in $100 every month on top of your principal, you’re giving compound interest more fuel to work with.

Bottom line? High rate + frequent compounding + long time + regular deposits = serious wealth building.

Where You’ll Encounter Compound Interest

Compound interest shows up in your life more than you think. Sometimes it helps you, and sometimes it hurts you.

Working in Your Favor:

When you’re saving or investing, compound interest is your friend. You’ll find it in savings accounts, certificates of deposit (CDs), investment accounts, and retirement funds like 401(k)s and IRAs. According to the U.S. Securities and Exchange Commission, these accounts let your money grow over time as interest builds on itself.

Working Against You:

But here’s the flip side: compound interest also applies to debt. Credit card balances are the worst culprits. The Consumer Financial Protection Bureau warns that compound interest on credit cards can make balances harder to pay back if you only make minimum payments.

If your loan balance keeps increasing even after making regular payments, you can read our detailed guide to know how compound interest and hidden costs cause debts to grow over time.

Some personal loans and student loans also use compound interest, which means your debt can grow faster than you expect if you’re not paying it down regularly.

The total cost of a loan also depends on how long you take to repay it and your interest rate. You can learn more in our article on how loan terms affect the cost of credit.

The key? Use compound interest to build wealth, not debt.

How to Maximize Compound Interest

I’ve learned the hard way that small moves make a huge difference when it comes to growing your money. Here’s what actually works:

- Start early. Honestly, this is the biggest regret I hear from people: waiting too long. Even $50 a month in your 20s beats $200 a month in your 40s because time does the heavy lifting.

- Pick accounts with higher rates. I once switched from a savings account paying 0.5% to one paying 4.5%: same money, way bigger growth. Shop around, don’t just stick with your first bank.

- Don’t touch your money. According to the Consumer Financial Protection Bureau, avoiding withdrawals helps your savings grow faster because you’re letting interest build on itself. Every time you pull money out, you’re killing the snowball effect.

- Add money regularly. Set up automatic transfers; even $25 a week adds up. The principal keeps growing, and so does your interest.

- Choose daily or monthly compounding over yearly. Some accounts add interest daily. That means 365 times a year, your money grows instead of just once.

Try these, and you’ll actually see the difference in your account balance.

How Compounding Works in the Real World

Let me tell you something most finance guides don’t explain well: compound interest isn’t just a theory. It shows up in your actual life every single day, and understanding where it’s working can change how you handle money.

In Your Savings Account

I opened my first savings account at 22, thinking I was being smart. But I didn’t realize my bank was only paying 0.1% interest while others offered 4%. That tiny difference? Over 10 years, it has cost me thousands.

Most traditional banks offer between 0.01% and 0.35% on standard savings accounts, while online and high-yield banks often pay 4% or more as of 2025.

Most savings accounts and high-yield savings accounts compound daily or monthly. That means every day, you’re earning a little bit on yesterday’s interest. It sounds small, but according to the Consumer Financial Protection Bureau, daily compounding adds up way faster than yearly compounding.

In Your Retirement Accounts

This is where compound interest really flexes. Your 401(k) or IRA doesn’t just grow from your contributions; it grows from all the dividends and capital gains reinvested over decades.

Let’s say you put $200 a month into a retirement account starting at age 25, earning an average 7% return. By 65, you’d have over $500,000. But if you wait until 35 to start? You’d only have about $240,000, even though you’re putting in the same amount every month.

That’s the real-world cost of waiting.

On Your Credit Cards

Here’s where it gets painful. Credit card companies love compound interest because it works against you.

If you carry a $5,000 balance at 18% APR and only pay the minimum each month, you’re not just paying interest on $5,000. You’re paying interest on the interest that keeps piling up. The CFPB warns that this can make balances much harder to pay off.

For example, if you carry a $5,000 credit-card balance at 18% APR and make only minimum payments (around $100 a month), roughly $40–$50 of that payment goes toward interest each month.

I watched a friend struggle with a $3,000 credit card balance for three years because she didn’t realize compound interest was adding $40–50 every month before she even made a payment.

In Your Investments

When you invest in stocks, mutual funds, or index funds, compounding happens when you reinvest your earnings instead of cashing them out.

Say you own shares that pay dividends. If you take that cash and spend it, you’re missing out. But if you reinvest those dividends to buy more shares, now those new shares also earn dividends. It’s compound interest in action.

You can actually see how much faster reinvested dividends grow using our Free Dividend Calculator. It shows how compounding boosts your long-term returns when you keep reinvesting instead of cashing out.

Warren Buffett built most of his wealth this way, not by picking lucky stocks, but by letting his returns compound for 60+ years.

In Real Estate

Even property uses compounding. If your house increases in value by 5% per year, that growth compounds. A $300,000 home doesn’t just add $15,000 each year; it grows faster because each year’s growth is calculated on the new, higher value.

After 20 years at 5% growth, that $300,000 home could be worth over $795,000.

Compound interest is everywhere: your savings, your debt, your retirement, even your home. The people who get rich aren’t necessarily smarter or luckier. They just understand how to put compounding on their side and give it time to work.

So ask yourself: where is compound interest working for you right now? And where is it working against you? Fix the second part, maximize the first, and you’re already ahead of most people.

The Rule of 72

Want a quick trick to figure out how long it takes your money to double? Meet the Rule of 72.

Here’s how it works: Take the number 72 and divide it by your interest rate. The answer tells you roughly how many years it’ll take for your money to double.

Let’s say you have a savings account paying 6% interest. Just do this:

So your money will double in about 12 years if you don’t touch it.

Another example? If you’re earning 8% returns on an investment:

I love this rule because you don’t need a calculator or fancy math. Just pull out your phone, do quick division, and boom, you know if your account is working hard enough for you.

It’s not perfect, but it gets you pretty close. Way better than guessing.

Final Thoughts

So there you have it, compound interest in plain English.

It’s not some complicated money secret. It’s just math working in your favor (or against you, if it’s debt). The real power comes from starting early, being patient, and letting time do the heavy lifting.

I’ve seen people stress about picking the “perfect” investment, but honestly? The best move is just getting started. Even a small amount growing at 5% will beat doing nothing at 0%.

Whether you’re building a retirement fund, growing a savings account, or paying off a credit card, understanding how compound interest works puts you ahead of most people.

My advice? Open that account today. Set up automatic deposits. Then let compound interest do what it does best: grow your money while you live your life.

Have you started using compound interest to your advantage yet? I’d love to hear what’s working for you.

FAQs

How much is $10,000 at 10% interest for 10 years?

If you invest $10,000 at 10% compound interest for 10 years (compounded yearly), you’d end up with about $25,937. That’s almost $16,000 in pure interest earnings. The longer you leave it, the bigger it grows.

What are the downsides of compound interest?

The downside? It works against you when you owe money. Credit card debt and some loans use compound interest, which means your balance grows faster if you’re not paying it down. What starts as $2,000 can balloon to $3,000+ if you only make minimum payments.

What are the risks of compounding?

The biggest risk is time working against you. If you’re in debt, compound interest can bury you deeper every month. Also, if your investment account loses value, compounding can’t help; you need positive returns for it to work. Market crashes can wipe out years of growth.

What is better than compound interest?

Honestly? Nothing beats compound interest for long-term wealth building. But if you want faster growth, investing in stocks or real estate can give higher returns than a basic savings account. The catch? Higher risk. Compound interest in a safe account is slow but steady.

At what point does compound interest really take off?

Most people see the magic around years 10-15. In the early years, growth feels slow. But once your interest earnings start outpacing your contributions, that’s when it explodes.

Here’s what happens at different stages:

- Years 1-5: Growth feels tiny. Your interest might only add $50-200 per year, depending on your balance.

- Years 5-10: You start noticing the difference. Interest earnings begin to match or beat what you’re adding manually.

- Years 10-20: This is where it gets exciting. Your money is now growing mostly from interest, not just your deposits.

- Years 20+: Compound interest does most of the heavy lifting. Your balance can double every 7-10 years without you adding a cent.

The rule of thumb? If you’re earning 7% returns, your money doubles every 10 years thanks to compounding. That’s the Rule of 72 in action (72 ÷ 7 = roughly 10 years).

So if you start with $10,000 at age 25, by age 55, it could grow to $80,000+ without any extra contributions. That’s 30 years of compound interest working while you sleep.

The takeaway? Don’t judge your progress in the first few years. The real magic happens when you’re patient enough to let time do its thing.